Perspectives: B2B Commerce

Uncovering the Next B2B Commerce Breakthrough in Southeast Asia

Understanding Southeast Asia’s B2B commerce landscape through the lens of:

- Global B2B Commerce trends

- Logistics as a key factor for success in two winning verticals within B2B commerce

- Emerging opportunities in Southeast Asia

B2B Commerce is shifting towards an omnichannel model

Online lead generation in B2B commerce is growing as internet access and digital payments rise, shaping an omnichannel approach.

Growth Drivers of B2B Commerce: Demand Surge and Enhanced Infrastructure

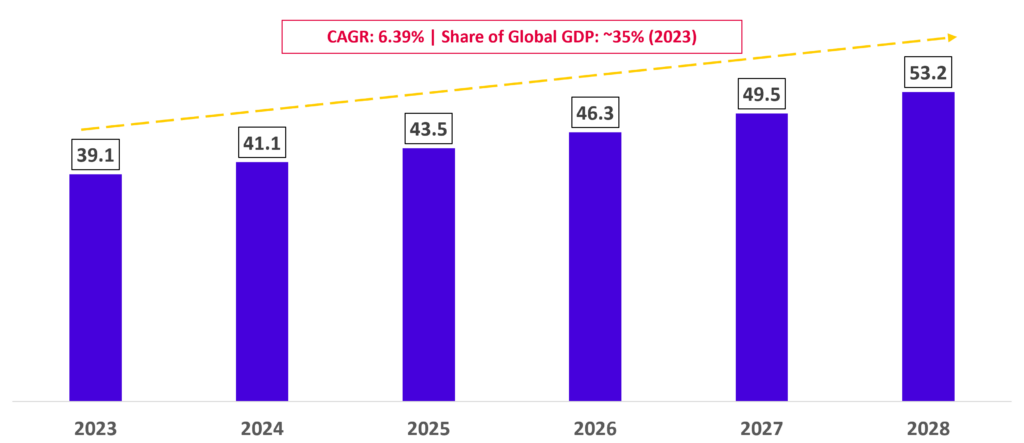

B2B commerce has experienced robust growth, driven by macroeconomic trends such as expanding middle-class demographics and rapid digitalization. This growth trend is illustrated in Fig 1, where global B2B expenditures reached US$39 trillion in 2023 and are projected to grow at a 6.39% CAGR, reaching US$53 trillion by 2028.

Key drivers include:

- Legacy Models Adaptation: Modern Trade (MT) excels in B2C transitions and omnichannel capabilities, while General Trade (GT) remains pivotal in emerging markets, facilitating last-mile distribution to smaller retailers.

- Digital Infrastructure Investments: Increasing investments in e-commerce and logistics infrastructure enable B2B companies to embrace digitalization more effectively.

- Asia’s Role in Global Demand: With rapid GDP growth and a rapidly growing population, Asia has become a global hub for e-commerce, driving substantial demand for goods and services and propelling growth in the B2B commerce sector.

Fig 1. Global B2B Commerce Market Size in US$ Trillions

B2B E-commerce Driving Industry Advancements

Within B2B commerce, three distinct verticals have been identified:

- Traditional Incumbents:

- General Trade (Inventory-Led): This includes traditional retailers such as mom-and-pop shops.

- Modern Trade (Inventory-Led): Modern Trade involves large-scale retail outlets like supermarkets and department stores.

- E-commerce

- Transaction-focused Inventory-Led: In this model, companies act as intermediaries that connect traders with buyers

- Inventory-Led: In contrast, companies in the inventory-led model hold inventory in stock and sell these to customers.

While GT and MT retain their relevance, the digital economy has catalysed the emergence of B2B e-commerce as a highly opportunistic vertical within the sector, highlighted in Fig 2. This shift underscores the sector’s adaptation to digital advancements and its capacity to capitalise on new market opportunities.

Fig 2. B2B E-Commerce Verticals

| Inventory-led | Transaction-focused | |

| # of Unicorns | 169 | |

| Total Valuations | USD 150B | USD 171B |

| Total Funding | USD 95.5B | USD 39B |

| Valuation-to-Funding Ratio | 1.75x | 4.38x |

| Next Steps | HIGH POTENTIAL | HIGH POTENTIAL |

Transitioning from Transaction-focused to Inventory-led in B2B E-commerce

Companies are prioritising lean operations and capital accumulation. As they scale, they harness customer data to implement a white-label strategy, integrating 4PL solutions to drive success.

Differentiating between Transaction-focused and Inventory-led business model

Transaction-focused Model: They maintain an asset-light model and leverage data to facilitate transactions and support both parties efficiently, maximising gross profits. Eventually inventory-led marketplaces will develop their own private / white label strategy and develop their offline retail presence, whether B2B or B2C, to optimize inventory management in an omnichannel strategy of lead generation and customer retention.

- Ex. Indiamart: Connecting manufacturers with sellers

Inventory-led Model: This approach often involves expanding into white-label products and offline retail, necessitating robust logistics infrastructure such as 4th Party Logistics (4PL) to manage scaling operations effectively.

- Ex. Udaan: Product procurement by category

- Ex. Amazon: Marketplace with white-label products

- Ex. Moglix: Specialises in Maintenance, Repair, and Operations (MRO) with integrated Software as a Service (SaaS) solutions.

Success Factors for B2B Commerce players

Success in B2B commerce hinges on key factors driven by both transaction-focused and inventory-led models:

- 4PL Capabilities: Having developed logistics infrastructure is key in building defensibility for B2B commerce. This should target Tier 2 and 3 cities, where logistics inefficiencies are most prominent. Similar to Udaan, logistics capabilities allow for companies to provide key services to customers, such as last-mile delivery services.

- White-label Brands: Inventory-led players must eventually develop or acquire brands or traditional distribution players to build their SKUs and increase their margins. These brands also need distribution channels outside of Tier 1 cities so they can access Tier 2 and 3 cities.

- Financing Solutions: Financing plays a crucial role in accelerating transactions and customer retention. Providing solutions to customers such as what Moglix did with Credlix is vital.

Fig 3. B2B Commerce Case Studies

| Indiamart | Amazon Business | Moglix | |

| Business Model | Transaction-focused | Inventory-led | Inventory-led |

| HQ | India | United States | Singapore |

| Revenue FY 2023 | $139.38M | $590B | $572M |

| Total Funding | $177M | $11.91B | $472M |

Identifying the next B2B Commerce opportunity in Southeast Asia

B2B commerce success hinges on brand acquisition, high margins through own brands, and strategic tier 2-3 city targeting as seen from global precedents.

Opportunities in Southeast Asia

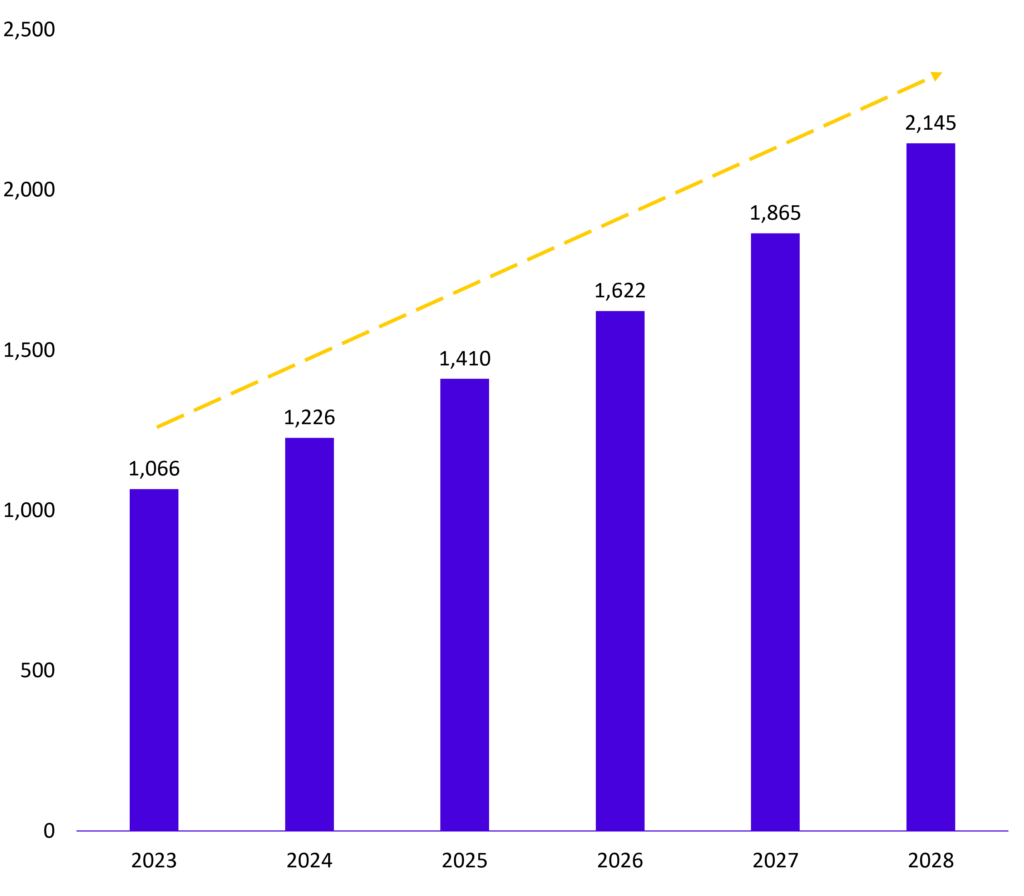

The B2B commerce market in Southeast Asia reached a value of $1.1 trillion in 2023 and is expected to double by 2028, growing at a CAGR of 15%. Key factors impact the space’s growth in the region:

- DFS Growth: Digital financial services are expanding, allowing B2B companies to use platforms for payments, financing, and risk management.

- ASEAN Integration: Cross-border business operations benefit from ASEAN’s economic integration, reducing trade barriers and expanding market access.

- Last-Mile Efficiency: SEA’s logistics infrastructure improvements enable efficient last-mile delivery for B2B commerce.

Fig 4. SEA B2B Commerce Market Size

Key Takeaways for B2B Commerce in Southeast Asia

- SEA follows a transaction-focused model that integrates SaaS e-procurement and financing solutions to get to scale.

- To increase margins, transitioning to inventory-led models typically occurs alongside white-label initiatives given the low margins of B2B commerce players.

- Strong logistics and distribution capabilities outside of Tier 1 cities should be built in the backbone to build defensibility.

- Players should target Tier 2 and 3 cities by ensuring that distribution channels are present in these markets.

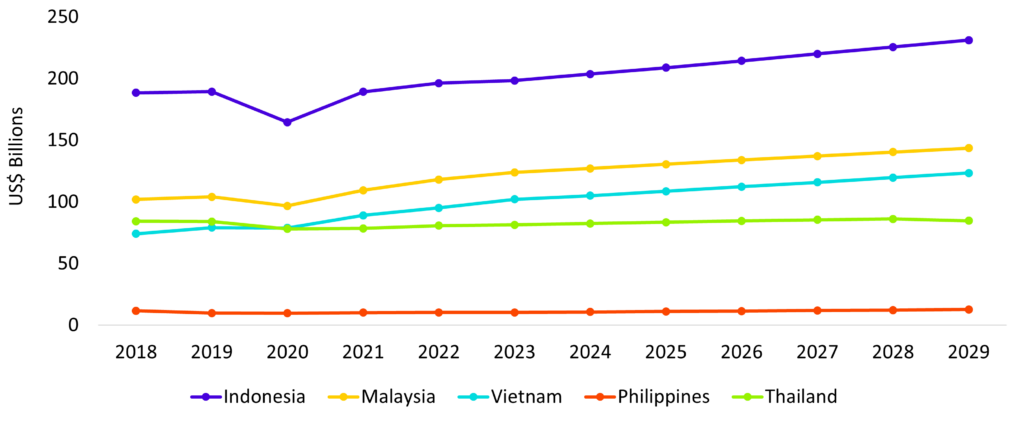

Given the findings from Fig. 5, the key markets to focus on are:

- Indonesia: Fast-Moving Consumer Goods (FMCGs)

- Malaysia: Consumer Brands

- Thailand, Vietnam, and Indonesia: Maintenance, Repair, and Operations (MRO)

Success in B2B commerce will be driven by a sales-centric approach in B2B MRO procurement, ensuring robust supply chains to meet the demand for high-demand and niche SKUs. For B2B FMCGs, leveraging a strong sales team and efficient last-mile logistics to reach tier 2 and 3 cities is the winning strategy.

Fig 5. SEA Value-add of Manufacturing

Author

Kristina Ticzon, Research Manager