Perspectives: Construction Tech in Southeast Asia

The Hunt for Southeast Asia’s Construction Tech category winner

Diving into Construction Tech’s large market with the following themes:

- Facing the macroeconomic challenges in the Construction Industry

- Identifying the most promising models given the opportunities in the space

- Defining what makes a Construction Tech giant

The construction industry is facing a perfect storm in Southeast Asia

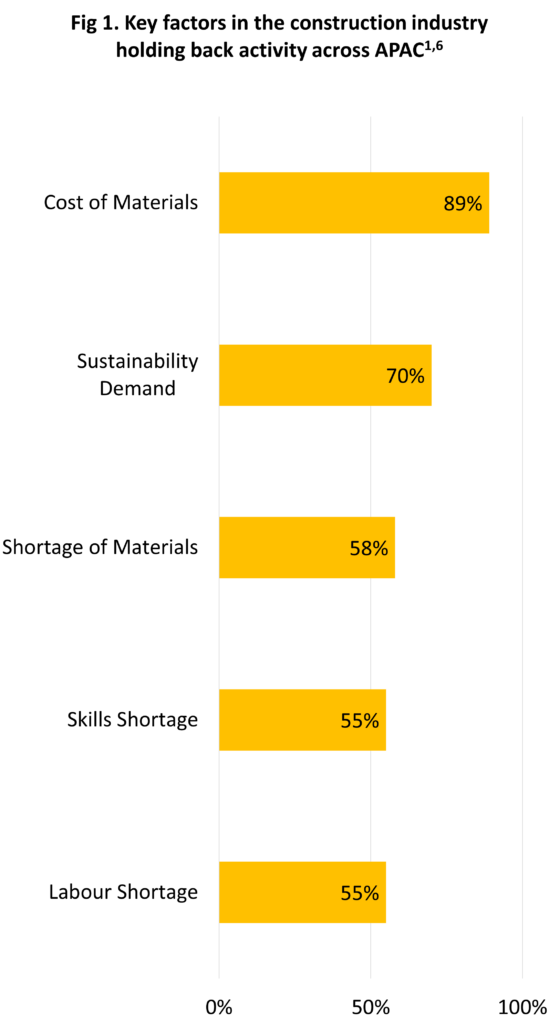

The construction industry is facing a range of challenges, including the ongoing pricing increases for labour and materials, and the demand for sustainability and innovation.

Increased cost sensitivity exacerbated by material shortages

Macroeconomic factors including supply chain bottlenecks and inflation continue to make price elasticity even more visible for the already cost-sensitive sector. Multiple geopolitical events in the past 2 years such as the Ukraine and Israel crises have increased the prices of commodities like oil, raw materials, and labour – further affecting construction costs.

Sustainability and Green Construction

Given that sustainability is a growing concern in SEA, there has been a rising demand to integrate energy and resource efficiency within the construction industry. Singapore has been Southeast Asia’s green building leader, with over 20% of its buildings as certified green buildings, serving as a precedent for the rest of the region.

Sustained Construction Labour Shortages

There is a severe labour shortage of around 1.2 million workers in Southeast Asia. Over 50% of companies in the region face skilled-worker deficits.3 The labour shortages in markets like Thailand, Malaysia, Indonesia, and the Philippines can be attributed to the worker migration into bigger global markets such as the US and UK due to higher salaries and opportunities offered abroad.

Emergence of AI, robotics and digitalization

In addition to labour shortages, labour-productivity growth in construction has also been shown to average at 1% annually compared to other sectors that average at 3%.5 AI and robotics are now being integrated into construction tech solutions to bridge this gap.

Construction tech offers a unique solution in Southeast Asia

A large market size, coupled with ongoing macroeconomic challenges, opens the field for construction tech players to resolve these challenges.

Opportunities in Southeast Asia

The construction industry offers one of the largest markets in the region with a market size that is currently valued at US$450 Billion and expectations of growing to US$1.4 Trillion by 2028 at a CAGR of 7.7%.

Driven by labour & material shortages, and the demand for sustainability & modernisation within the region, an opportunity to tailor tech solutions enabling the following is now present:

- Efficiency across the construction value chain.

- Unique products to better serve sustainability and modernisation.

- Improved reach to previously inaccessible areas.

Identifying the models present in SEA

After a deeper dive into the regional players in the market, Marketplaces, Collaboration Software, and Frontier Tech & Robotics have been identified as key models within the space.

- Collaboration Software: Platforms functioned with project management, document management, and collaboration tools.

- Marketplaces: Centralised platforms for procurement of supplies and materials.

- Frontier Tech & Robotics: Players who develop and enable Drones, AR/VR, and Construction Robots

Overview of models within Construction Tech

| Business Models | Categories | No. of Unicorns | Total Funding |

| Frontier Tech & Robotics | Drones | 3 | $5B |

| AR/VR | 2 | ||

| Construction Robots | 2 | ||

| Marketplaces | Equipment Share | 3 | $4.4B |

| Other Marketplaces | 4 | ||

| Collaboration Software | Project & Task Management | 8 | $3.1B |

| Other Collaboration Tools | 2 |

Though Frontier Tech & Robotics leads the group in total funding and Collaboration Softwares produced the most number of unicorns, the Marketplace model is highlighted given its ability to do the following:

- Connect fragmented markets in the region.

- Provide a foothold for unique products and services, such as access to materials and supplies, as well as financing.

4 Key Characteristics of Successful Construction Tech Giants

Understanding the importance of strategic expansion, product innovation, and lasting customer relationships in the construction landscape.

Strategic positioning in Tier 2 and Tier 3 cities

By redirecting attention to small yet high-growth cities, companies may create a more defensible market presence, fostering growth in regions not as extensively addressed by major players. Targeting Tier 2 and Tier 3 cities is then one of the key factors construction tech players need to double down on as Tier 1 cities are already dominated by established players due to the efficiency in these areas, leaving no room for entry in Tier 1 cities.

Service expansion & brand building

While marketplaces consolidate construction materials and provide a more convenient access point to supplies, players that provide collaboration software tools as a part of the platform also further create a closed ecosystem for stakeholders. This is pivotal for addressing the evolving digitalisation needs of construction companies and increasing efficiency within the industry.

Products oriented towards a large TAM

Given the construction industry’s large TAM and the ability of marketplace players to access high TAM verticals, offering proprietary products tailored to these verticals – such as Paints & Coatings for the construction industry – enables companies to increase their margins from take rate/commission to gross profit models.

Customer engagement leading to repeat business

Deeper customer engagement through logistics tracking leads to repeat business. The ability to provide in-depth visibility into the shipping process plays a pivotal role in gaining customer trust. This transparency not only satisfies immediate expectations but also cultivates long-term customer loyalty.

Author

Kristina Ticzon, Research Manager