Perspectives: D2C – Edition 5

The Investment Case For D2C House of Brands in Southeast Asia

Within this edition, we focus on the topic of D2C House of Brands, and ask ourselves the following questions:

- Why now and how large is the opportunity in Southeast Asia?

- What will it take for a Southeast Asia champion to emerge?

Southeast Asia is primed for the emergence of D2C House of Brands

The SEA growth of E-Commerce and D2C have reached an inflection point

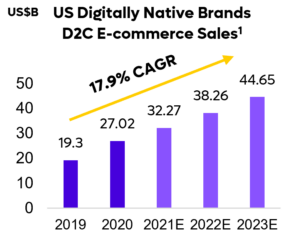

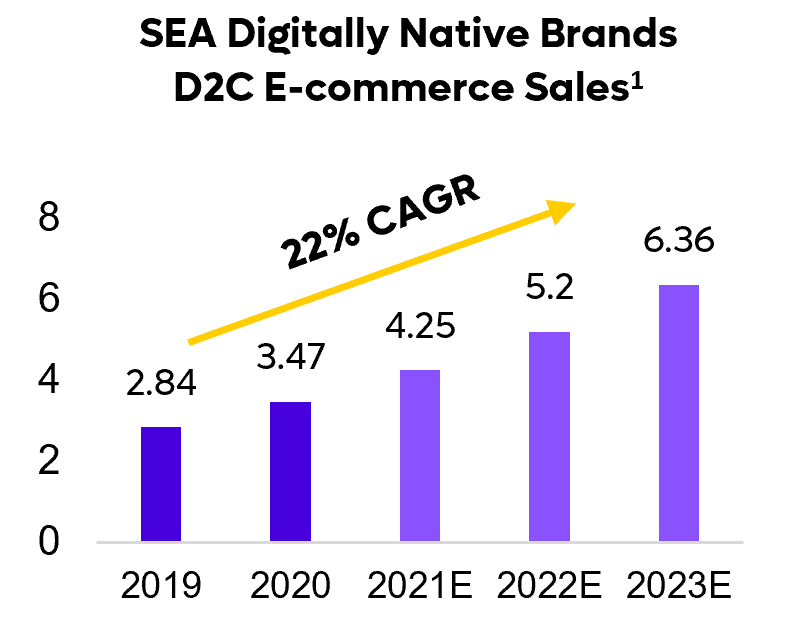

The overall e-commerce market has seen SEA outpacing global markets in terms of growth rates. Similarly, the D2C market displays similar growth trends with SEA outpacing the US1. Early signs of D2C success can be seen in the closing gap between SEA vs global e-commerce penetration rate.

Leveraging offline channels are key

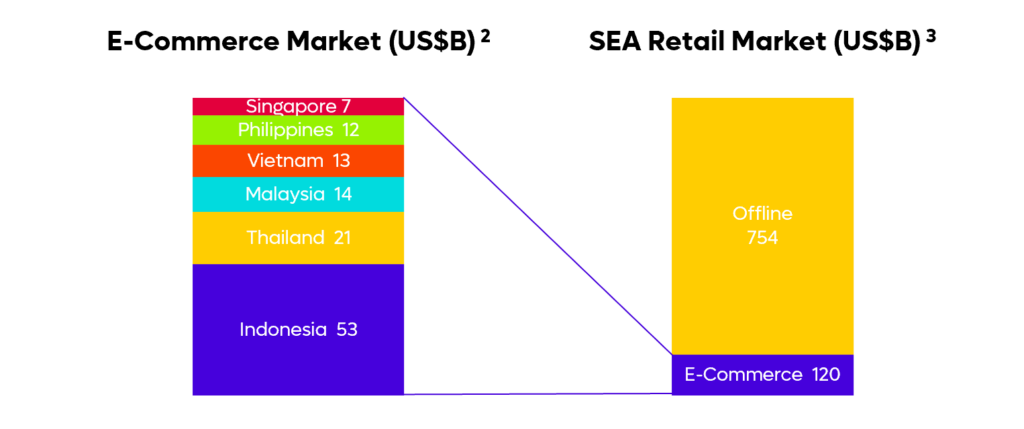

Across Southeast Asia, Indonesia presents the most potential with the largest E-Commerce market (US$53B) followed by Thailand and Malaysia.

However, an often overlooked facet of D2C is the need to leverage offline channels – which offer over 6x the market size of eCommerce.

D2C offers favorable unit economics

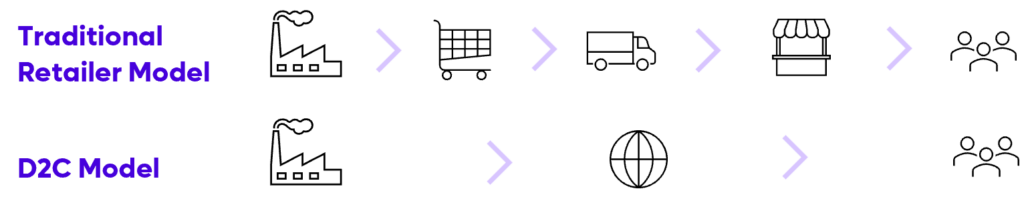

D2C offers greater margins over traditional brands along with comparatively higher Customer Acquisition Costs (CAC) due to the use of online platforms and limited to no third party distribution channels and fees4.

With stronger customer relationships and service levels forged from cutting through the middlemen, the D2C model adds to a more personalized experience, enabling a higher customer lifetime value (LTV) to acquisition costs.

House-of-Brands provide scale benefits

With the inflection of e-commerce, D2C businesses are expected to grow at an accelerated rate, transforming how users purchase. House-of-brands (HOB) models demonstrate several advantages over standalone brands through centralization and integration.

| Centralized Functions | Advantages |

| Marketing | Lower CAC |

| Supply Chain & Logistics | Lower COGS and logistics cost |

| Financing | Better access to working capital |

| Technology | Higher operating efficiency |

| Consumer Insights | Higher customer LTV |

Key Success Factors

Consistent / synergistic target market and product mix

Through optimizing for clear synergy across brands and products offered, players can achieve a significantly higher LTV to CAC ratio. For example, via cross-selling to a single customer base.

Takeaway: Addressing a large, consistent, and clear customer base is key to building critical mass for D2C players.

Buy model – key factors

The acquisition (ala Thrasio) approach to growing D2C brands offers rapid scaling opportunities, but typically requires additional factors to be successful:

- Access to low-cost acquisition capital (via banks and lending partners)

- Differentiated acquisition strategy – i.e., the non-price reason why a divesting brand owner would pick you vs others

- Strong M&A capabilities (thoughtful sourcing, screening and efficient closing processes)

Build out of strong platform resources and capabilities

D2C players should seek to in-source key group functions such as marketing, sales, logistics and the technology stack upon which brands are run.

Takeaway: D2C House of Brands build defensibility over time via repeated, and effective use of these platform resources. Pure arbitrage on buying brands cheaply is not sustainable.

Build model – key factors

For players that adopt an ‘in-house’ approach to building new brands and products (ala Xiaomi, Razer, etc.), a different set of factors becomes critical:

- Effective R&D capabilities – allowing such brands to rapidly test and refine products before and during launch

- Access to reputable OEM and contract manufacturing partners to allow for ‘at scale’ production before MOQs are hit

Author

Kristina Ticzon, Research Manager