Perspectives: Telehealth – Edition 3

The Investment Case for Telehealth in Southeast Asia

Within this edition, we focus on the topic of Telehealth, and ask ourselves the following questions:

- Why now?

- How large is the opportunity in Southeast Asia?

- What will it take for a Southeast Asia champion to emerge?

Southeast Asia is now primed for the emergence of Telehealth

i. Rising Healthcare Expenditures

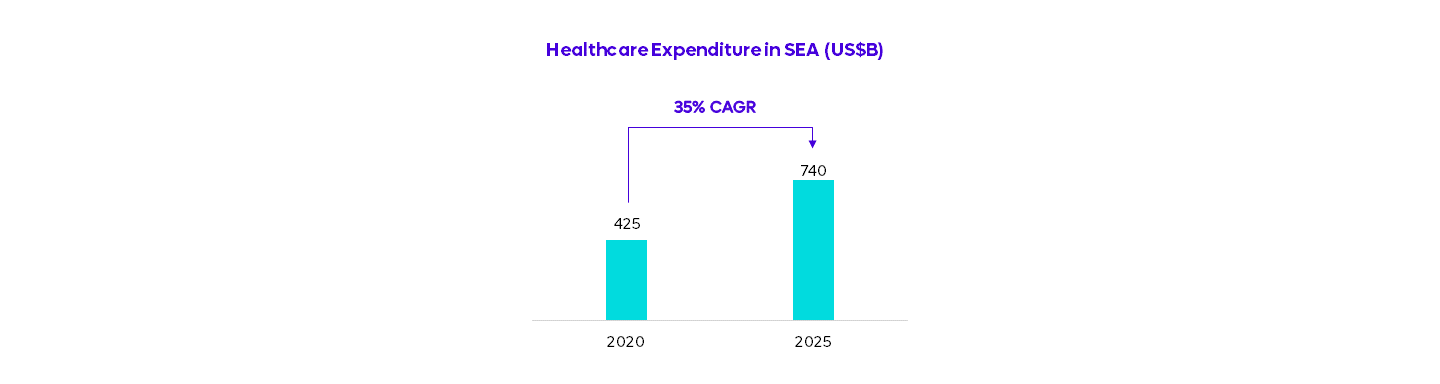

Healthcare expenditure in Southeast Asia is growing significantly faster than GDP. Healthcare spending in the region is projected to grow from US$425B in 2020 to US$740B by 2025.

This is largely driven by the ageing population (% above age 60 will grow from 9.6% in 2016 to 13.6% in 2025), as well as the prevalence of non-communicable and chronic diseases in the region.

ii. Uptake of Digital Services

The number of internet users in Southeast Asia is increasing rapidly, from 360M in 2019 to 400M in 2020. The majority of new consumers notably come from non-metro areas.

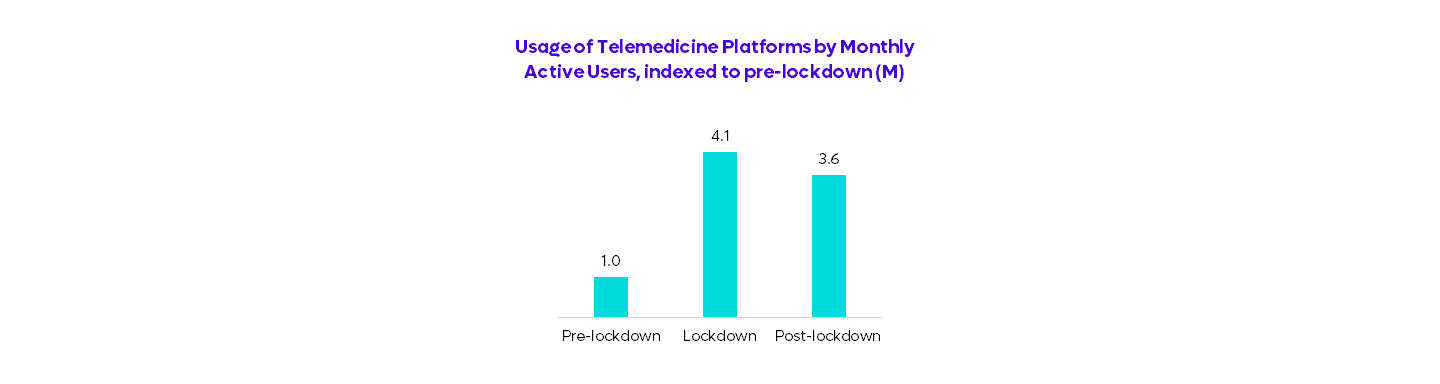

HealthTech usage in the region expanded by 4x in 2020, accelerated by COVID-19. Digital health services retained the majority of users even after the strictest lockdown period, and consumers in the region are expected to utilize more digital health services over the next 5 years.

iii. Public and Private Sector Support

Governments are increasing support for telehealth by issuing policy changes, formal advisories, and forming partnerships such as those between the Ministry of Health in Indonesia and Halodoc.

Pan-Asian insurance companies and local giants such as Grab have partnered with Telehealth startups, including Doctor Anywhere and Ping An Good Doctor, in the private sector.

iv. Increasing Funding

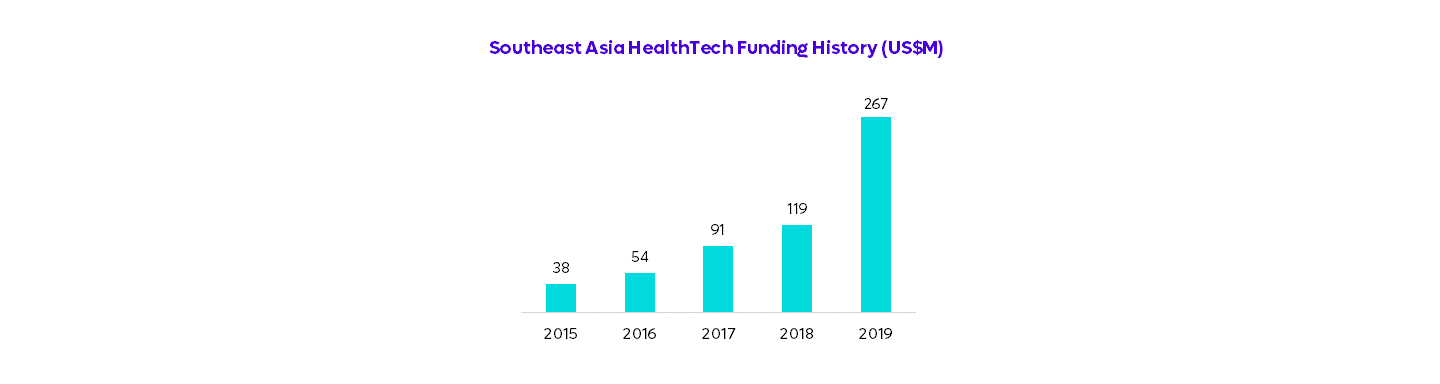

Institutional partnerships and investments in recent years have legitimized the telehealth industry as a new pillar in the delivery of healthcare services.

The HealthTech sector in SEA had a record-breaking funding level of US$267M in 2019. This is on top of a 41% CAGR in deal volume since 2014. Major deals included Halodoc (US$65M) and Alodoktor (US$33M).

The remaining hurdles present four opportunities for innovative players to overcome

i. Patient Acceptance

Despite growth in usage, the persistence of Telehealth usage remains untested post-COVID-19. For example, 57% of patients whose appointments were affected by COVID-19 would resume in-person care as soon as the pandemic resolves.

Patients are also more likely to use Telehealth for routine checkups (45%) vs more urgent care (19%).

Telehealth players should aim to create ‘sticky’ relationships with customers vs. classic ‘transactional’/ ‘one-off’ platform opportunities.

ii. High Marketing and Customer Acquisition Costs

Telehealth companies face high marketing and Customer Acquisition Costs (CAC). Teladoc, a leading telehealth company, had selling and marketing expenses of ~US$380M (34.8% of revenue).

Existing Southeast Asian players such as Halodoc effectively relied on a “freemium” model to grow a customer base and focus on monetizing existing users.

Establishing strong unit economics from the outset is essential to outweigh the relatively high CAC investments necessary to shape user behaviour.

iii. Fragmented Healthcare Ecosystem

The healthcare system in Southeast Asia is diverse and highly fragmented. Countries such as Vietnam and the Philippines have over a thousand municipal, provincial, and national autonomous health systems. Telehealth companies must navigate each complex healthcare system to consolidate a large base and emerge as local winners.

As regulators rapidly shape emerging policies, maintaining an open dialogue and compliance-forward position can become a competitive moat.

iv. Lagging Infrastructure

Digital infrastructure continues to restrict ‘real-time’ consultation capabilities, with Vietnam, Indonesia and the Philippines scoring among the lowest internet connection speeds compared to broader APAC and OECD nations.

From a care provision perspective, Southeast Asia has a relative undersupply of hospital beds, qualified physicians and nurses.

Players that help enhance efficiency and reduce loads on the existing healthcare system can play a critical role in improving health outcomes in the region.

Author

Kristina Ticzon, Research Manager