Perspectives: AgriTech – Edition 6

The Investment Case For AgriTech in Southeast Asia

Within this edition, we focus on the topic of AgriTech, and ask ourselves the following questions:

- How does Southeast Asia and the global markets compare in terms of the maturity of the AgriTech Industry

- Why is Indonesia one of the leaders of AgriTech in Southeast Asia

- Which business model(s) are potential winners in the regional value chain

Market Opportunities

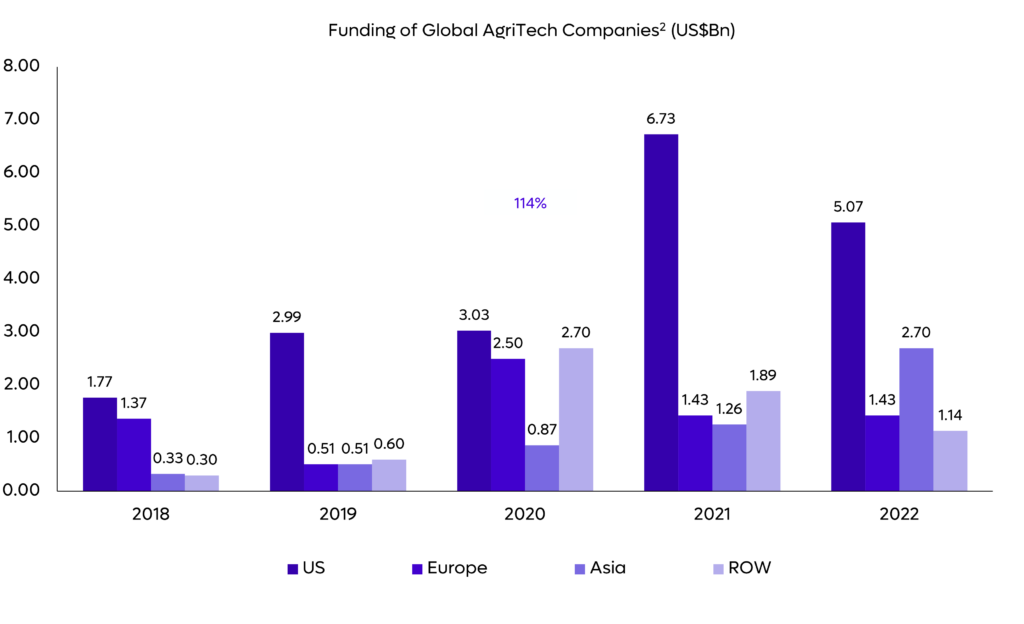

While AgriTech in the US and ROW have historically been the most funded, Asia has attracted significant investment activity, as shown by its growth in funding of 114% in recent years.

Southeast Asia’s Agriculture Market Opportunities

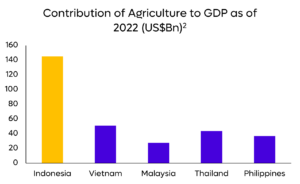

In 2019, the agri-food sector’s total contribution to GDP across Southeast Asia was around US$717 billion, representing a 30% increase over five years.

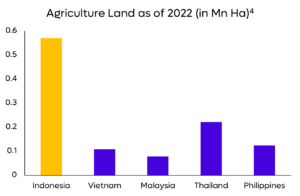

Malaysia and Indonesia accounted for more than 90% of the world’s palm oil exports, and more than 40% of the rice imported to the EU came from Vietnam, Thailand, Myanmar, or Cambodia during the period 2019-2021.

SEA’s agriculture sector’s employment rate grew by 4.9 million jobs between 2015 and 2019, representing an 8% increase over the past 5 years.

Indonesia is ripe for innovation in this historically traditional market

| India | China | US | Indonesia | |

| Agriculture value

(of GDP) 1 | 16% | 17.1% | 0.9% | 12.7% |

| Agriculture value (US$B) 1 | 476 | 856 | 165 | 128 |

| % of Total Farms that are small holder

(Landholding < 2ha) 2 | 86.2% | 98% | 4% | 93% |

| Average Plot Size (ha) 3 | 1.1 | 0.4 | 178.4 | 0.6 |

| Mechanization Rate4 | 40% | 67% | 76% | 10% |

| Below Poverty Line Rate in Smallholder Farmers (%)5 | 20% | 28% | 10% | 18% |

| Digital Penetration (%)1 | 47% | 70.9% | 19.8% | 73.7% |

| Ripe for Innovation6 | High | High | Medium | High |

Indonesia’s agriculture industry makes up a significant portion of its GDP, but indicators suggest that the region is still highly inefficient compared to other regions.

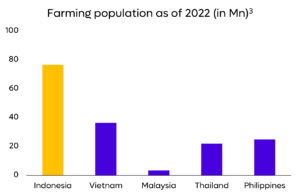

- A large percentage of smallholder farmers in the region typically do not have access to the same technology/resources as larger commercial farms.

- Low mechanisation rate and high supply chain inefficiencies create opportunities for innovation and disruption.

- High digital penetration and a relatively low poverty rate among farmers present an opportunity for a high adoption rate.

Why Indonesia?

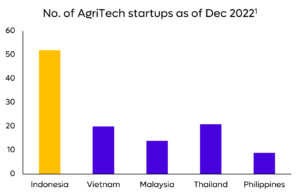

For AgriTech, Indonesia has the most mature startup ecosystem, and its large farming population is conducive to the region’s growth in the coming years.

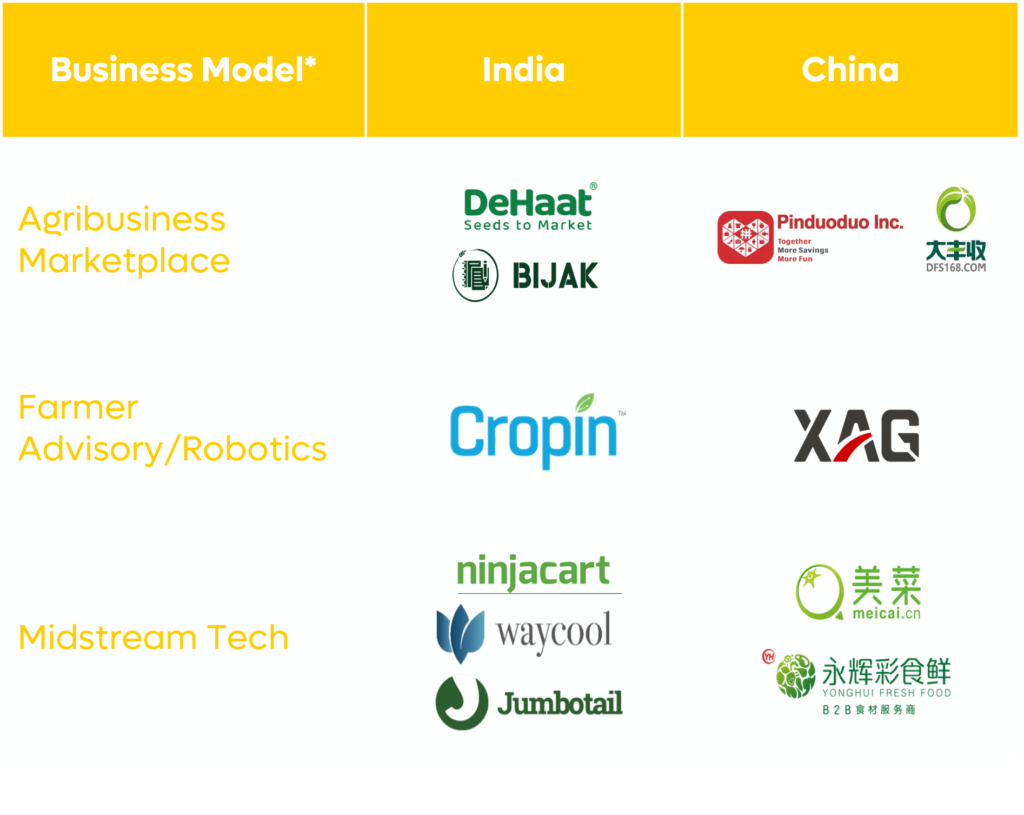

Agricultural tailwinds that have led to successful business model precedents in India and China

Agriculture Tailwinds

- Food security threat: Climate change and labour scarcity due to rapid urbanization while rising demand for food outpaces products

- Digitization: Growing smartphone penetration and internet adoption among both consumers and farmers

- Supply chain inefficiencies: COVID-19 disrupted supply chains and caused a shift to digital platforms

- Favourable government impetus: Government reforms to increase farmers’ income and build food sufficiency through technology

- Consumer preferences: Growing disposable incomes lead to consumers demanding food with specific characteristics (e.g.Organic, traceability)

Due to the following micro tailwinds and COVID-19, there has been an increase in investment in the upstream of the agri-food chain

Below are several viable business models that we see in each segment of the value chain

| Value Chain | Sector | Description of Typical Business Model | Examples |

| Farm inputs | Agri Inputs Supply Chain | Providing logistical infrastructure between brand principals, farmer stores/ farmers |

|

| Farming | Farm Mechanization | Provide autonomous equipment or robotics to assist in automating everyday on-farm tasks |

|

| Precision Agriculture | Optimizes or automates tasks like seeding, irrigating and harvesting using machine learning software/hardware |

| |

| Farm Management | Provides farmers assistance through a subscription-based software that provides dashboards, insights and monitoring capabilities to increase efficiency |

| |

| Post-production | Agri Output Supply Chain | Online marketplace solutions for agriculture good with a strong supply chain and logistics, connecting farmers, processing plants and consumers |

|

| Across value chain | Pure Fintech | Providing financing solutions or payment infrastructure throughout various stages of the value chain including farmer stores, farmers or traders |

|

Key Success Factors for AgriTech in Indonesia

- Closed-Loop System: Working towards building an end-to-end integrated solution to establish a closed-loop system through providing input supplies, financing access and output offtake at the end of the harvest cycle.

- Build out Critical Mass: Focus on building their presence in certain areas/provinces by establishing a strong supply chain network and relationships with key stakeholders (Community Leaders, Principals, Distributors, etc).

- Farmer-Centric Model:

- Business models that provide direct support to farmers in scaling output and improving overall yield efficiency

- Direct access to farmers is crucial as a market entry into a fragmented value chain

- Hybrid Offline/ Online Business Model:

- Utilize ‘fit for purpose’ tech- simple mobile applications with remote, low bandwidth environment operations

- Offline presence is crucial for farm management, harvest tracking, and farmer education

Author

Kristina Ticzon, Research Manager