Perspectives: EdTech – Edition 3, Issue 2

An Extension of the Investment Case For EdTech in Southeast Asia

Post-Covid EdTech Landscape in Southeast Asia: A Promising Horizon

- What is the outlook for EdTech in Southeast Asia?

- The next promising EdTech market

- What are the key success factors to win the market in the region?

Acceleration of EdTech In Southeast Asia (SEA)

Various drivers create a promising landscape for EdTech companies to grow in SEA

Post-Covid Behaviour

In the previous edition of our EdTech Perspectives, we noted an increase of over 200% in website traffic and EdTech application downloads due to COVID-19. Post the pandemic, educational institutions continue to embrace digital tools and online platforms to complement traditional teaching methods as these platforms provide valuable data on students’ performance and create personalised learning experiences by using algorithms.

Strong Government Support on the Sector

In SEA, government expenditure on education ranges from 15% to 22%. Notably, the region’s education priorities revolve around STEM, Vocational, Digital and Early Childhood. One such example is the partnership between UNICEF and the Vietnamese government to foster gender equality for digital learning as part of the country’s 10-year strategic plan. The government also ensured that 1M underprivileged students will be equipped with electronic devices for online learning.

Rising Internet Penetration

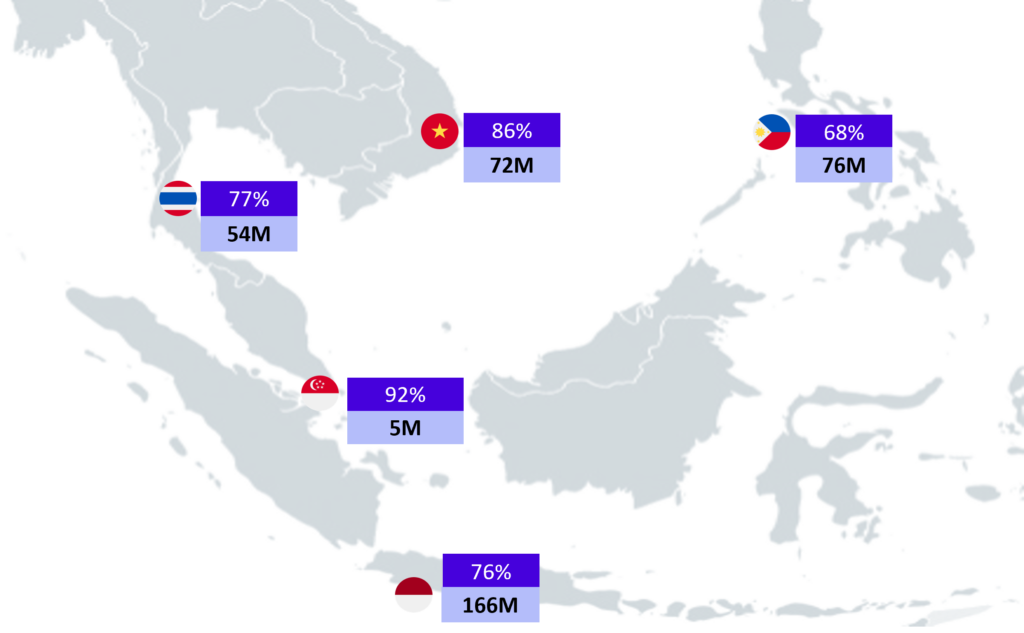

Since our previous Perspectives, the SEA internet penetration rate had risen to 80% , with Vietnam (72M) and Indonesia (166M) leading with one of the most internet users in SEA. This significant connectivity empowers greater access to online education, including remote regions, thereby enabling a larger user population to benefit from virtual learning opportunities.

Fig 1. The Southeast Asia Internet Penetration Rate and Internet User population as of 2022

Increasing Focus for Private Education

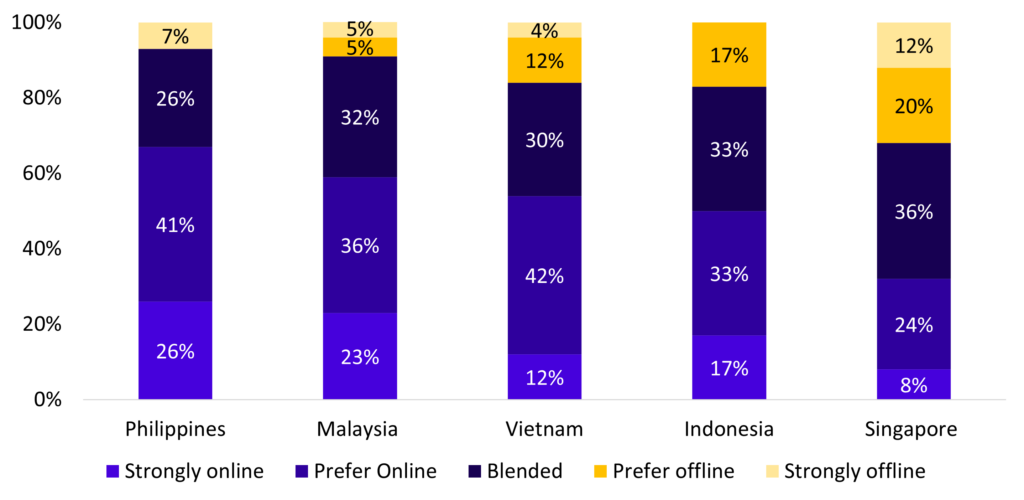

The private education expenditure in SEA has surged to nearly US$60 billion7, creating a lucrative opportunity for EdTech companies. With its impressive growth forecast and substantial upside potential, EdTech holds a prominent position, particularly in the Philippines, Malaysia and Vietnam (Fig 2).

Fig 2. Demand for online/offline after-school learning across SEA countries in 2022

Vietnam offers a sizeable and lucrative opportunity

Evaluating the attractiveness of SEA markets to discover the largest potential for EdTech

EdTech across Southeast Asia

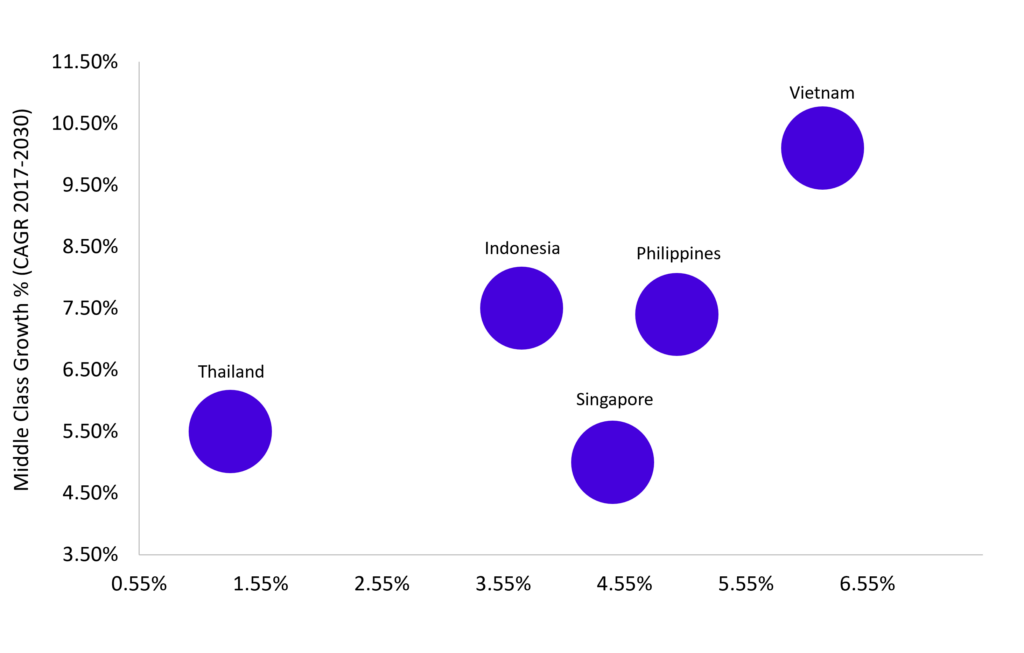

The EdTech industry is witnessing significant market opportunities driven by rapid urbanisation, concentrated demand for affordable private education, and the expanding middle class population. Although Indonesia has the highest middle-class growth, Vietnam shows promising growth opportunities with the highest EdTech market size and willingness to spend on education (Fig 3). Therefore, EdTech companies in Vietnam can tap into the demand for accessible and affordable education to serve the growing middle class.

Fig 3. Middle Class Growth with Expenditure on Education as % of GDP in 2022

Why Vietnam presents an attractive market

- In Vietnam, the government allocates a substantial portion of its annual budget to education – ranging from 14% to 17%, making education the highest expenditure category

- The rising internet penetration in Vietnam (3.4M new internet users between 2021-2022) enhances the accessibility to e-learning and paves the way for EdTech expansion

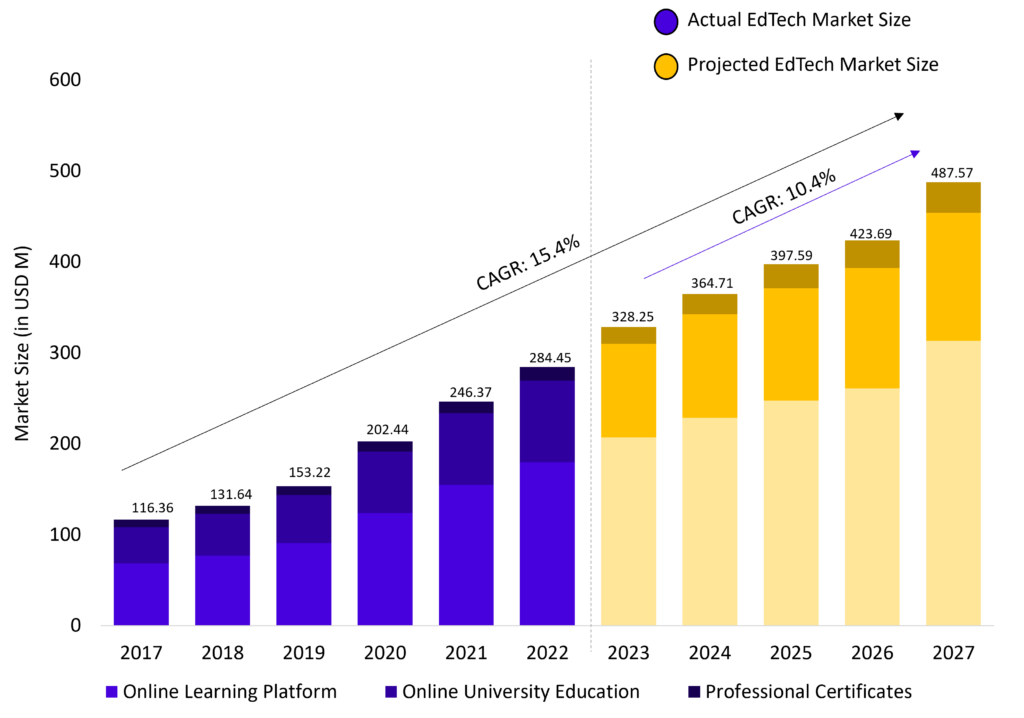

- From 2023-2027, Vietnam is projected to experience market growth of 10.4% (Fig 4)

- During the pandemic, 79.7% of high school students in Vietnam adopted remote learning, becoming familiar with digital tools

- Vietnamese spend over 30% of their income on their children’s education, indicating a high willingness to spend for the future of their children

Fig 4. Vietnam EdTech Market Size and Growth

Choosing the winning vertical

K-12 is the most attractive sector with the largest global TAM and valuations of unicorns emerged

| Sector | Global TAM | Number of EdTech Unicorns Globally16 | Total Unicorns Valuation | Total Funding to Unicorns | Rank |

| K-12 | US$ 180.0B | 12 Unicorns (ByJu’s, YFD, ZYB, Outschool, Quizlet) | US$ 62.7B | US$ 15.1B | 1 |

| Professional Learning | US$ 111.7B | 14 Unicorns

(Udemy, Udacity, Huike, Masterclass, Degreed, Yunxuetang, Guild Education) | US$ 26.6B | US$ 6.5B | 2 |

| Language Learning | US$ 31.1B | 2 Unicorns

(VIPKid and iTutorGroup) | US$ 5.5B | US$ 1.4B | 3 |

| Learning Management Systems | US$ 13.4B | 2 Unicorns (GoGuardian, LEAD School) | US$ 2.1B | US$ 0.4B | 4 |

Rising demand and support for K-12 in Vietnam

- Global case studies indicate that K-12 EdTech has greater defensibility compared to Language Learning as K-12 education requires specialised knowledge and software

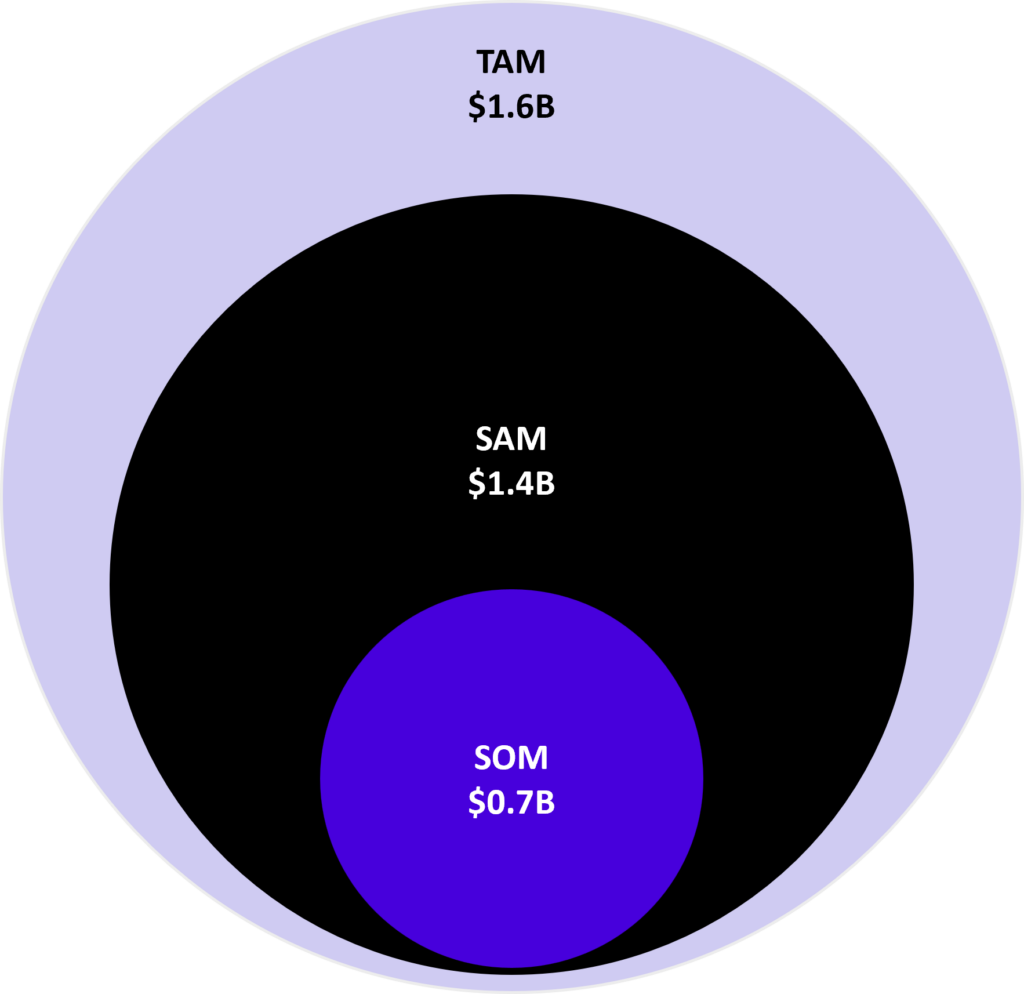

- In Vietnam, the K-12 Total Addressable Market (TAM) is US$1.6B, presenting a huge market opportunity

- Vietnam is transforming into a technology and innovation hub, supported by the government as they promote and integrate STEM education within the educational system to address the rising demand

Fig 5. Vietnam K-12 Market Size in 2021

How EdTech players can become a market leader

Key success factors for SEA EdTech players include creating scalability through large live group classes, defensibility through product synergies, and localization via content

Scalability

- The EdTech market has a significant market size, necessitating a scalable technology infrastructure to meet the growing demand

- One potential approach is to offer large live stream classes with a personalised touch to enjoy higher margins and a scalable business model

Product Differentiation

- EdTech players who have a comprehensive suite of products can promote upselling and cross-selling, to significantly reduce customer acquisition cost

- This creates a seamless customer experience and acts as a customer conversion funnel

- The integration of AI into EdTech products will allow for further differentiation in the EdTech space

Strong Unit Economics

- A high Lifetime Value to Customer Acquisition Cost (LTV/CAC) ratio suggests healthy gross margins and promising prospects for business expansion

- Achieving strong unit economics involves optimising customer acquisition costs while concurrently enhancing customer retention rates

- Global peers with strong flywheels achieve significant improvement to Unit Economics at scale

Localisation

- The varying education curricula across different countries underscore the importance of localization and adapting educational content to meet specific market needs

- Moreover, implementing the flywheel effect by collecting and leveraging students’ data over time offers first-movers a competitive advantage and allows them to offer a localised learning curriculum

Author

Kristina Ticzon, Research Manager