View the full issuehere

Perspectives

Perspectives: EWA – Edition 7

Perspectives

The Investment Case For EWA in Southeast Asia

Within this edition, we focus on the topic of EWA, and ask ourselves the following questions:

- Is EWA the answer to financial inclusion in Southeast Asia?

- Why Vietnam, and why now?

- What will it take for a Southeast Asia champion to emerge?

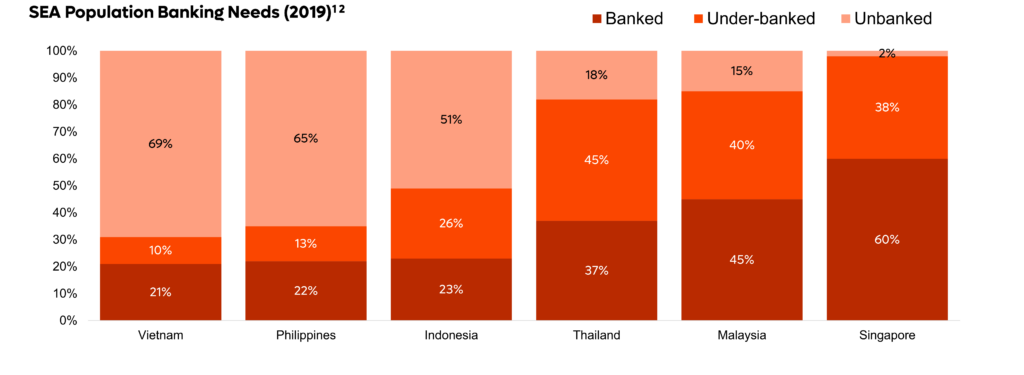

In SEA, more than 70% of the population is underbanked/unbanked

Drawback of existing solutions

- Bank loans: Inaccessible to those whom are unbanked

- Credit cards: Inaccessible to those without banking relationships or with credit scores

- Loan sharks: Though accessible, loan sharks charge extremely high interest rates and can create a vicious cycle of borrowing

- Staff loans: Some low-income workers turn to their employers for loans but this is not widely provided across companies and is not easy to obtain approval. It is often the last option due to the social stigma and embarrassment

Did you know?

- In Southeast Asia, the unbanked and underbanked population amounts to ~200M and ~100M respectively

- Vietnam, Philippines and Indonesia contribute almost 94% of the unbanked and 67% of the underbanked, signalling the huge untapped potential of these 3 markets

The market opportunity for EWA in Southeast Asia stands at US$13B

Ideal EWA user

- Blue-collar worker: Need access to credit

- Digitally savvy: Ease of access

- Stable employer (i.e. FDIs): Lower credit risk

Did you know?

| Indonesia | Indonesia’s EWA readiness | Vietnam | Vietnam’s EWA readiness | Philippines | Philippines’ EWA readiness | |

| Population | 276M | 100% | 98M | 50% | 114M | 75% |

| Unemployment rate | 4.4% | 50% | 2.2% | 75% | 2.4% | 75% |

| Exported goods | US $246B | 50% | US $340B | 75% | US $88B | 25% |

| Internet users | 53% | 50% | 70% | 75% | 49% | 50% |

| FDI3 | US $11B | 50% | US $20B | 75% | US $0.63B | 25% |

…with Vietnam offering a unique market opportunity for EWA due to its unique positioning as a global manufacturer and export hub

EWA is a foot in the door to other offerings, and a unique “low risk” means to help blue-collar workers with broader financial services

|

Global Precedent(s) | Synergies with EWA | |

| Payments |

| Workers can make mobile payments with their salary, which in turn allows for tracking of their spending to fine tune EWA disbursements |

| Savings Management |

| For workers that are not using EWA, they can deposit their surplus earnings in savings account to earn interest |

| Salary Card |

| Employers can deposit workers’ salary in prepaid cards for employees to use |

| Insurance |

| Microinsurance can be provided to employees by risk-pooling from employers and setting aside a target from their salary for insurance premium |

| Financial Coaching |

| EWA provides data on employees’ usage which is useful in providing financial education and coaching for them to manage their finances |

| HRM

Human resource services |

| EWA integrates with the payroll system which allows for more services offered to employers |

Key Success Factors of EWA in Vietnam

Financial services focused preferred over HRM

- EWA and other financial services provide access to the previously underserved

- Large employers and FDIs mostly have existing HRMs, thus competing in a red ocean

B2B2C VS. B2C

- B2B2C model trumps the B2C model as it allows EWA players to take on more enterprise credit risk rather than consumer risk – which is hard to assess, especially for blue-collar workers

Single-country focused

- EWA players should focus on gaining market share in one country first and go through the trials and nuances of the market to develop a playbook for expanding to other countries

- Trying to target many countries at a go may lead to hitting similar speedbumps on all countries at the same time

Access to lower cost of capital

- Having access to a lower cost of capital such as securing a debt facility will allow loan disbursements to grow in a scalable manner without the use of equity financing which is expensive

Team Capabilities

- Having a strong team with the local expertise and relevant experience is important for execution in this space

- This includes having a risk team, account management/customer success team, government relations and tech team