Perspectives: Mom & Baby – Mini Sprint

A Deep Dive Into the Mom & Baby Market

Understanding Southeast Asia’s Mom & Baby landscape through the lens of:

- Increasing innovation within Mom & Baby products

- Key Success Factors of Mom & Baby players globally

- Mom & Baby opportunities in Southeast Asia

Mom & Baby as a Product-First Led Vertical in E-commerce

As shifting consumer preferences drive innovation within the Mom & Baby segment, 3 primary models have emerged to deliver products to this niche market.

Global Mom & Baby Market Overview

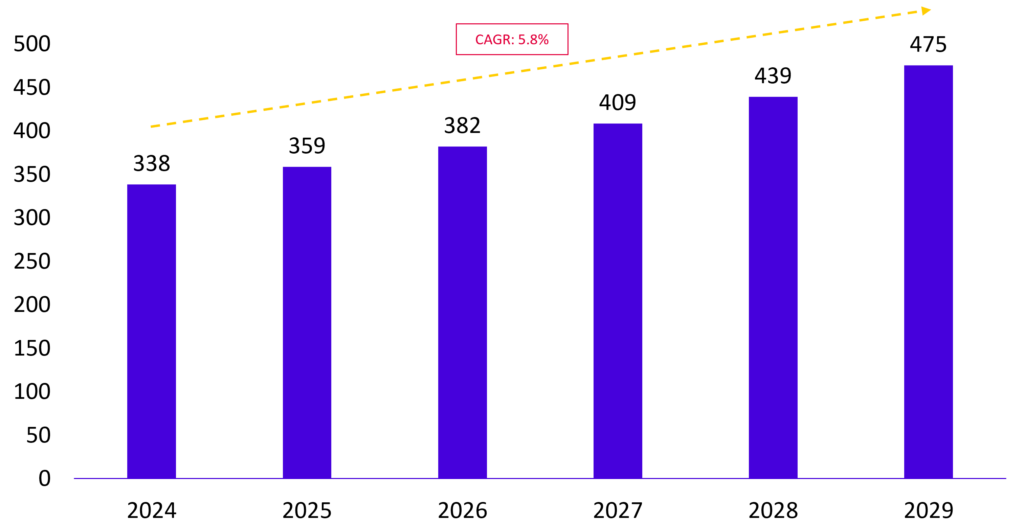

The global Mom & Baby products market is currently valued at $338 billion as of 2023. It is projected to grow to approximately $425 billion by 2024, with a compound annual growth rate (CAGR) of 5.8% expected over the coming years (see Figure 1). The Asia-Pacific (APAC) region contributes over 43% of revenue in the Mom & Baby segment as of 2023.1

Several key factors drive this growth:

- Changing Consumer Preferences of Parents: There is a rising demand for higher-quality products driven by increasing disposable incomes, the emergence of new technologies and materials, and a growing interest in sustainable alternatives.

- Community-Building for Parents: There is a growing interest in educational resources and community support for new parents.

- Emergence of Niche E-commerce Segments: With e-commerce maturing, vertical integration into niche segments drives the growth of the Mom & Baby segment.

Fig 1. Global Mom & Baby Commerce Market Size in US$ Billions

Business Models within the Mom & Baby space

- Marketplace First: This model evolves from a online marketplace, moving into utilising offline sales channels and eventually building their white/private labelling products based on the data collected from marketplace transactions. A strong branded offline presence and private-label products is key for this model.

- Product First: This model distributes Direct-to-Consumer (D2C) Mom & Baby products, ideally targeting tier 1, 2, 3 markets. Typically players start distribution through online channels prior to moving into offline sales, focusing on more SKUs.

- Forum First: These parenting forums eventually move into marketplaces or become lead generators for D2C companies or other marketplaces and product first companies. Products are sold on online marketplaces, leveraging the platform for online lead generation.

Fig 2. Mom & Baby Business Models

| 1. Vertical Marketplace-first | 2. Product-first | 3. Forum-first | |

| Global Examples | FirstCry | MamaEarth | Babylist |

| Types of Exits | IPO | IPO | NA |

| Revenue Model | Take Rate, Margin on Private Label Products, Franchisor Royalties | Margins on Products | Subscriptions to Communities, Services, Advertising, Lead-generation |

| Opportunity | Low Opportunity

Weak Unit Economics in the Absence of White/Private Label Products | High Opportunity

Strong Unit Economics and Easier to Scale, especially if FMCGs | Low Opportunity

Extremely Weak Business and Revenue Model |

Strategic Approaches in the Mom & Baby Sector as Seen from Global Players

Leveraging Omnichannel Integration, Micro-Influencer Marketing, and Targeting Key Product Segments to Drive Growth and Market Penetration.

Product Segments in Mom & Baby

Seven categories within the Mom & Baby segment have been identified as top product categories. Among these, Baby Cosmetics and Toiletries emerges as the category with the largest market share, where baby diapers and skincare products are the top global products under the segment.

- Baby Cosmetics & Toiletries

- Baby Food

- Baby Safety & Convenience

- Baby Toys & Play Equipment

- Baby Clothing

- Baby Nursery & Furniture

- Baby Feeding and Nursing

Success Factors for Mom & Baby players

As seen from Figure 3, findings from selected case studies conducted on global precedents demonstrate the following trends:

- The forum-first model struggles to monetise due to its reliance on providing free services, which makes it challenging to generate revenue.

- The marketplace-first model faces thin margins. As a result, white labeling becomes a necessary strategy to expand revenue streams for this model.

- Pivoting to white labeling their own products is particularly challenging for both forum-first and marketplace-first, as evidenced by precedents set by companies like theAsianparent and FirstCry.

Given these findings, it was determined that the Product-first model showed the largest potential with key success factors of the following:

- Product-first Model as a global champion: Product-First companies targeting tier-2,3 markets typically have higher margins and can scale faster than other models.

- Community for Increase Retention: Players like MamaEarth developed product prior to building community by collaborating with public figures for brand awareness and customer loyalty.

- Targeting Popular Product Segments: While established players dominate the diaper and skincare category, it remains a promising area where new companies can compete by offering products across budget, mass, and premium segments tailored to different regions and preferences.

Fig 3. Mom & Baby Case Studies

| First Cry | MamaEarth | AsianParent | |

| Business Model | Marketplace First | Product First | Forum First |

| HQ | India | India | USA |

| Revenue FY 2023 | US$710M | US$179M (2022) | -US$6.8M |

| Total Funding | US$501.50M | US$87.65M | US$41.6M |

Delivering the next Mom & Baby Champion in Southeast Asia

Product-first diaper players targeting tier-2 and tier-3 cities through micro-influencer marketing and omni-channel strategies will dominate Southeast Asia.

Opportunities in Southeast Asia

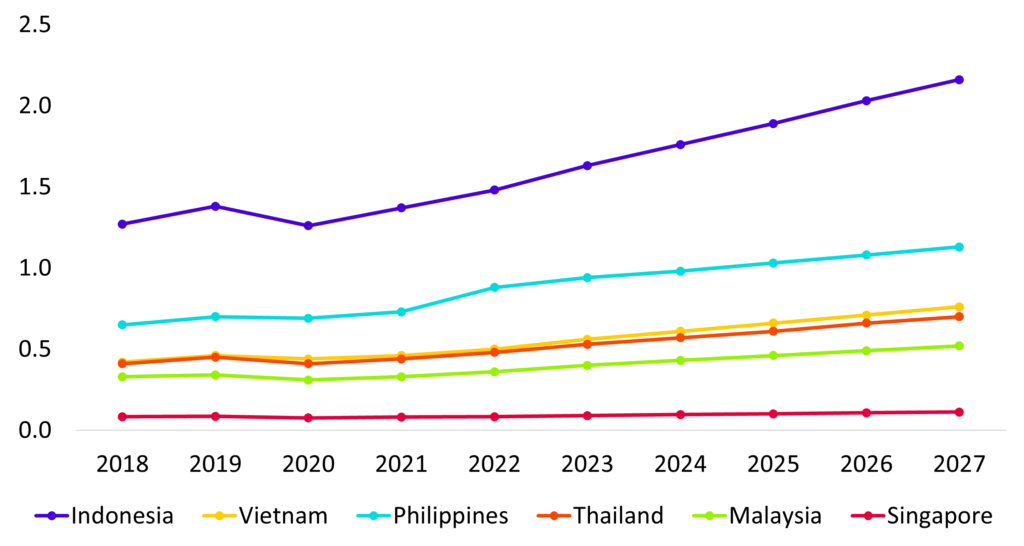

Household expenditures on baby products are projected to rise across all major Southeast Asian economies, soon reaching US$1.5 billion.1 As shown in Figure 4, the regional Mom & Baby market was valued at $1.12 billion in 2022 and is expected to grow to $1.5 billion by 2026.

Several key factors present opportunities for regional champions to emerge in this space:

- Fragmented Mom & Baby Market: The parenting market in Southeast Asia is characterized by a lack of consolidated sources of information and services, leading to disparities in product quality and accessibility.

- Large Youth Population in SEA: Southeast Asia has a youth population rate of 34%, providing a significant base for tailored solutions and technologies that help young parents adapt to life with a newborn.2

- Rising Disposable Incomes: Increased disposable incomes allow parents to invest more in premium and high-quality products for their children, focusing on safety, health, and convenience.

Fig 4. SEA Mom & Baby Market Size in US$M

Key Takeaways for Mom & Baby in Southeast Asia

- Product-First Advantage: Growth in the Mom & Baby space is more easily achieved by product-first companies with strong product-market fit. The product-first model tends to scale faster compared to marketplace-first businesses as marketplaces have smaller margins and need huge GMV to scale.

- Omni-Channel Strategy: A strong online and offline presence through an omni-channel strategy is critical for customer acquisition and maximizing revenue. This should be coupled with clear expansion plans for tier-2 and tier-3 markets and smart influencer marketing.

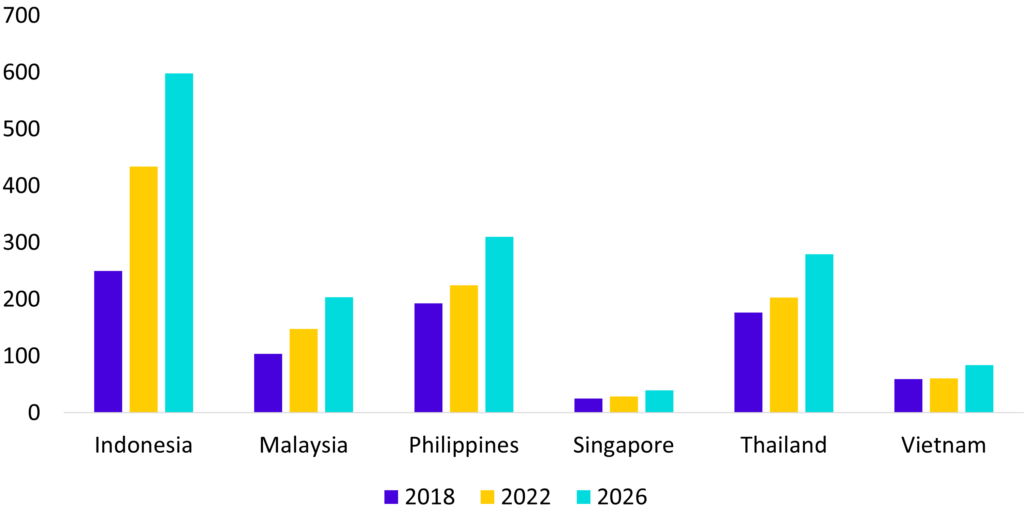

- Opportunistic Diaper and Skincare Segment: As seen in Figure 5, baby diapers has generated over $3B in sales as of 2023. Entering segments with high total addressable market (TAM) such as baby diapers and skincare presents the largest opportunity for Mom & Baby players due to the demand for product diversification in these areas.

- High-Potential Markets: Indonesia, Malaysia, Vietnam, and the Philippines are the four main markets with high potential in the Mom & Baby space given the high sales of baby diapers shown in Figure 5.

Fig 5. SEA Diaper Sales in US$B