Perspectives: Social Commerce – Edition 4

The Investment Case For Social Commerce in Southeast Asia

Within this edition, we focus on the topic of Social Commerce, and ask ourselves the following questions:

- Why now and how large is the opportunity in SEA?

- What will it take for a Southeast Asia champion to emerge?

Southeast Asia is primed for the emergence of Social Commerce

The E-Commerce opportunity is shifting to 2nd, 3rd tier, and rural cities

Traditional E-Commerce have not been accessible to 2nd, 3rd tier, and rural markets due to low e-commerce literacy and trust, and the recent inception of Social Commerce has been a game changer for the underserved population.

Observations from global precedents have shown that Social Commerce has been able to achieve faster growth than overall E-Commerce by serving lower tier cities and rural areas.

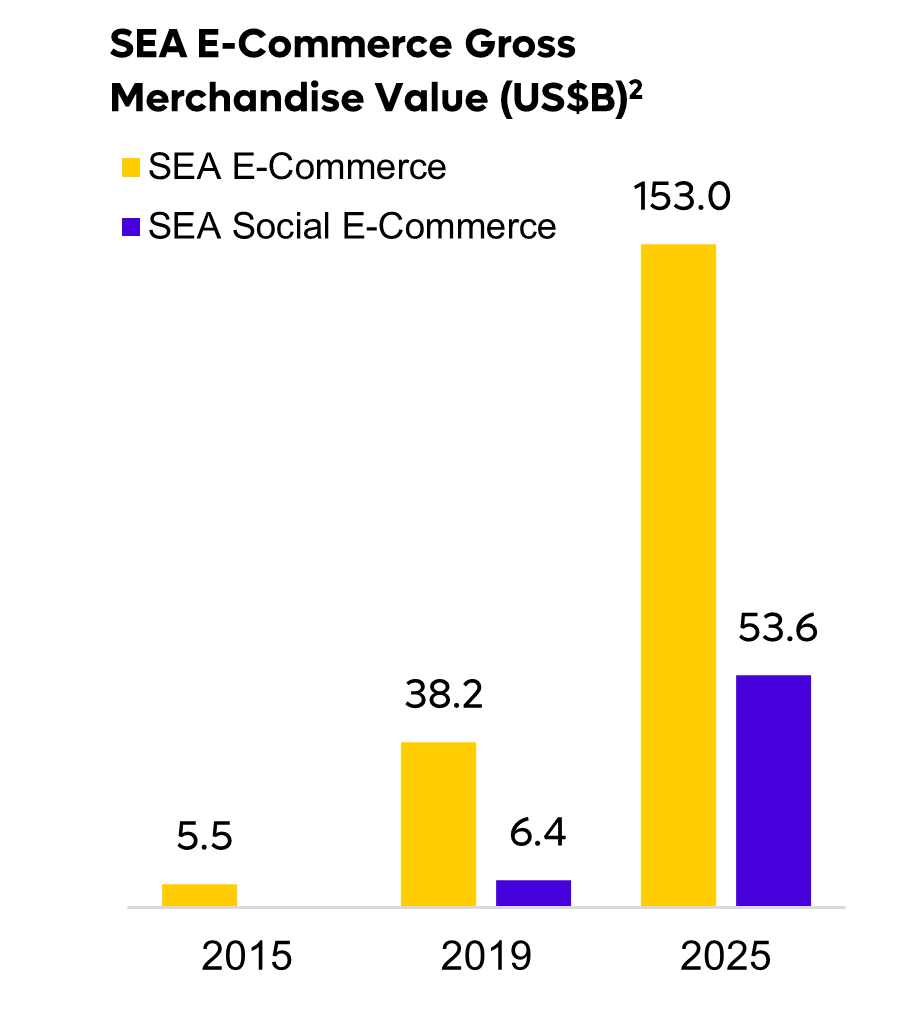

Huge Market Potential

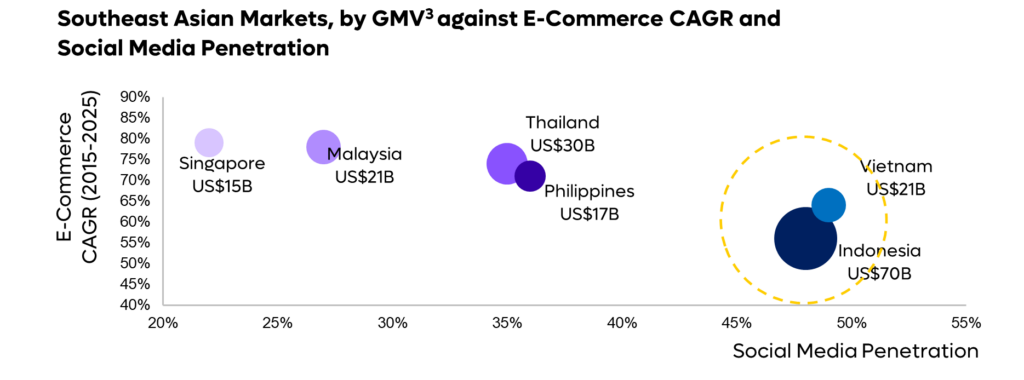

Across Southeast Asia, Indonesia presents the most potential with the largest E-Commerce market (US$70B GMV in 20213), along with high growth and social media penetration rates. With 2nd, 3rd tier, and rural areas still under penetrated yet representing >80% of the market4 Social Commerce currently tackles an unmet Total Addressable Market (TAM) of US$141B2.

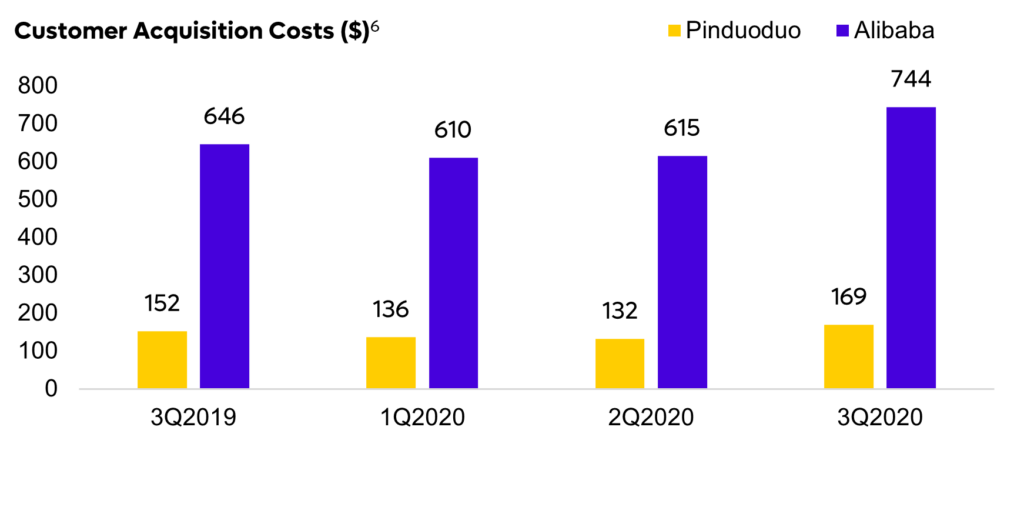

Social Commerce offers better unit economics

A higher conversion rate of 6% – 10% in Social Commerce vs 0.3% – 0.4%5 in traditional E-Commerce models thereby suggests greater margins for merchants4 and comparatively lower Customer Acquisition Costs.

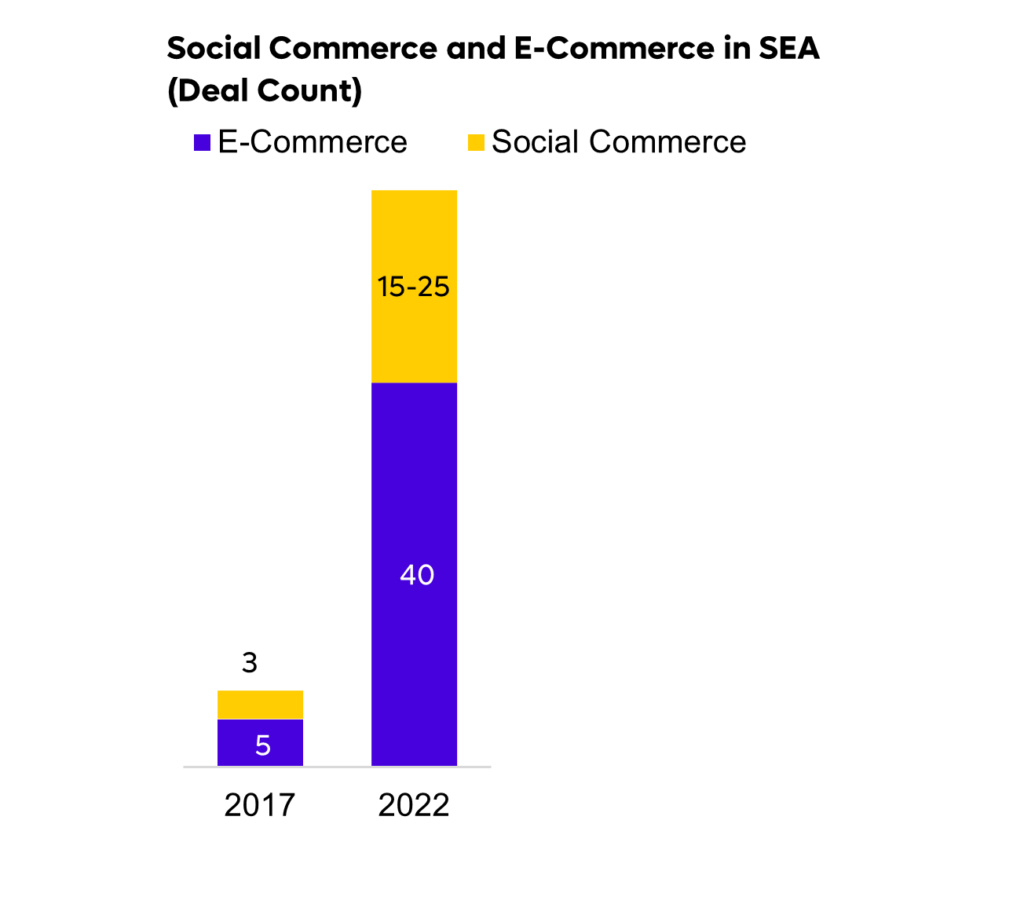

Until now, a clear winner has not emerged

The Social Commerce market in SEA is rapidly emerging with only one player reaching Series C stage in SEA thus far, signaling that the market is primed for a winner.

With regional E-Commerce unicorns currently predominantly 1st tier cities in Southeast Asia, Social Commerce operates in a blue ocean and presents new opportunities from existing incumbents in E-Commerce.

Key Success Factors

Hybrid Business Model

- In Southeast Asia, business models in Social Commerce typically adopt one of 4 models of Group Buying, Community Buying, Membership-based, and Content Sharing.

- We believe a hybrid approach of both Community and Group Buying is required to optimize players’ reach by lowering CAC, operations, and logistic costs while facilitating sufficient demand density in lower tier cities.

Critical Mass

- The market has reached an inflection point driven by the overall maturing of the E-Commerce market, social media penetration and GDP per capita.

- Building localised critical mass (e.g., by town / city) will be key in achieving economies of scale necessary to address 2nd, 3rd tier, and rural markets which represent >80% of the Indonesian population.

Navigate Local Nuances

- Relevant operational expertise in FMCG along with strong supply chain know-how are key to developing a winning model in the market.

- Deep on-the-ground operating capabilities allow hyper-localisation necessary to cater to local nuances.

Supply Chain Optimization

- With a less mature logistics infrastructure (e.g., vis-a-vis China), successful players will require self-managed warehouses combined with outsourced logistics to optimize supply chains, such as through the Consumer to Manufacturer (C2M) approach.

- Other capabilities include the optimization of concentrated orders and pre-order models, as well as leveraging on community leaders for last-mile fulfillment.

Strong Unit Economics

- With E-Commerce players mostly competing in 1st and selected 2nd tier cities, the CAC for traditional e-Commerce models has been increasing, as growth of internet shoppers begins to flatten2 yet marketing costs continue to accelerate.

- By leveraging on community leaders to aggregate orders, the average order value increases, lowering the logistics cost in respect to GMV through deliveries made in bulk. Strong product-market fit of Social Commerce in lower tier cities are crucial to minimise CAC and increase retention rates.