View the full issuehere

Perspectives

Perspectives: Telehealth – Edition 3, Issue 2

Perspectives

The Investment Case For Telehealth in Southeast Asia

Within this edition, we focus on the topic of Telehealth, and ask ourselves the following questions:

- What are the key challenges facing Telehealth in Southeast Asia?

- What is the right model to win the market in the region?

SEA is primed for the emergence of Telehealth…

Rising Telehealth Expenditures

- Telehealth expenditures in SEA are growing significantly faster than GDP (projected to grow from US $425b in 2020 to US $740b by 2025).

- It is largely driven by an ageing population (% above age 60 will grow from 9.6% in 2016 to 13.6% in 2025)2 and the prevalence of non-communicable and chronic diseases in the region.

Public and Private Sector Support

- Governments are increasing support for Telehealth by issuing policy changes, formal advisories, and forming partnerships.

- In the private sector, Pan-Asian insurance companies and local giants such as Grab have partnered with Telehealth startups including Doctor Anywhere and Ping An Good Doctor.

Uptake of Digital Services

- # of internet users in SEA are increasing rapidly from 360m in 2019 to 460m in 2022.

- Telehealth usage in SEA expanded by 4.5x at peak in 20204, accelerated by COVID-19, and digital health services retained most of their users even after the end of the lockdown period, as shown in the following chart.

Usage of Telemedicine Platforms, by MAU, indexed to January 2020 (Pre-lockdown)

Increasing Funding

- Institutional partnerships and investments in recent years have legitimised the Telehealth industry as a new pillar in the delivery of Healthcare services.

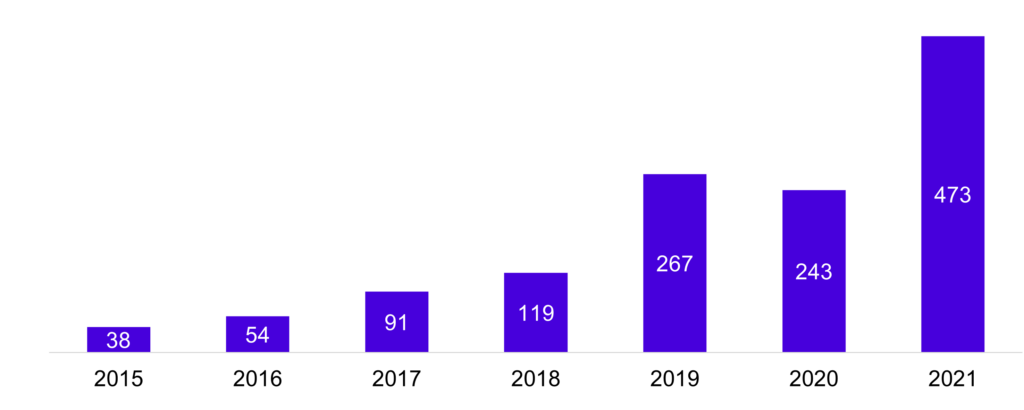

- Telehealth in SEA had a record-breaking funding level of US $473m in 20215 , which is on top of a 41% CAGR in deal volume since 20145, as shown in the following chart.

SEA Telehealth Funding History (US $m)

…but still face some key challenges

Persistence of Patient Acceptance

- Patients are more likely to use Telehealth for routine checkups (45%) vs. more urgent care (19%).

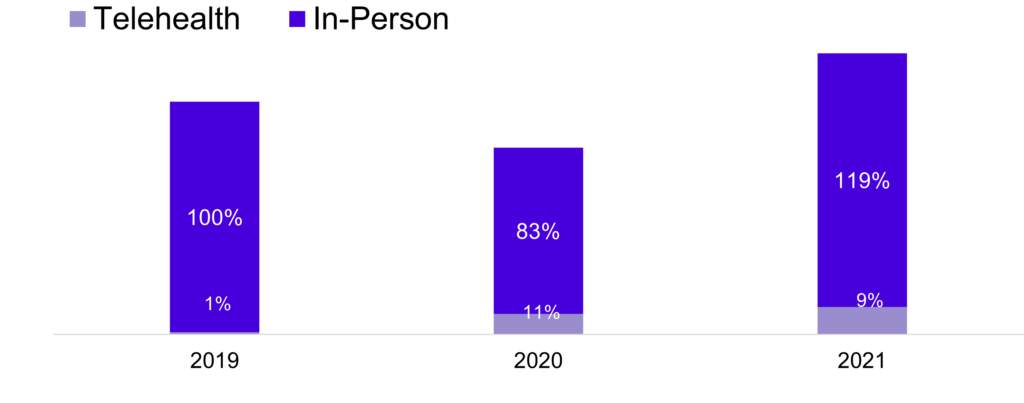

- In the US, the overall number of outpatient visits in 2022 have recovered to pre-pandemic levels and the usage of virtual Telehealth is 38x more than before the COVID-19 pandemic7, as shown in the following chart

Outpatient Visit Types Before the Pandemic

Inequitable Telehealth Accessibility

- Telehealth companies still face challenges in targeting the underserved market segment of individuals who lack access to both telehealth and traditional healthcare services.

- The cost of devices required to access telehealth services may serve as a barrier for those who cannot afford them.

- Further, individuals who can afford these devices are often those who already have access to traditional healthcare.

Lagging Infrastructure

- SEA’s relative undersupply of hospital beds and qualified physicians and nurses9 have worsened since post-pandemic – Health workers are maldistributed and rural areas are often understaffed.

- Further exacerbated by the mass migration of workers to other countries, it has become increasingly challenging to attract new professionals to join the Telehealth industry due to the low salaries and poor working conditions.

High Customer Acquisition Costs

- Telehealth companies are generally faced with high selling markets experiencing high customer acquisition costs

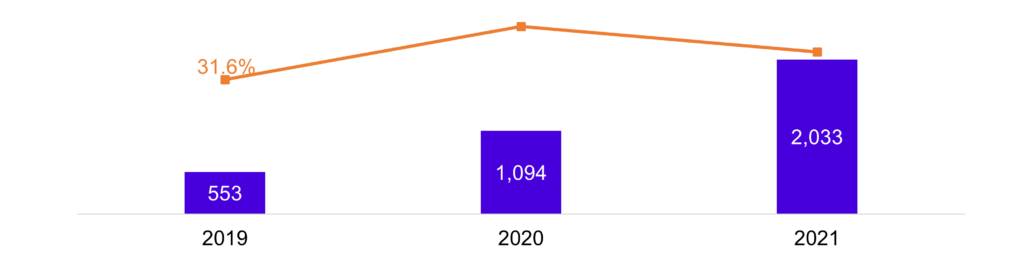

- Teladoc Health Inc, a leading Telehealth company had selling and marketing expenses of US $380m (34.8% of revenue) over FY 2020. In 2021, this skyrocketed to US $667m in 2021 and US $820m TTM10 , as shown in the following chart

Teladoc Health Inc. Selling and Marketing Expenses (% of Revenue, in USD $’000)

4 common business models that are typically adopted by telehealth players – We believe Specialised Vertical players are advantaged

| Key Models | Marketplace/Platform | B2B SaaS/Enabler | Specialised Verticals | Online Full Stack |

| Description | Provides patients access to a wide range of Telehealth providers online | Creates the necessary infrastructure and tools for Telehealth providers to conduct Telehealth services, but do not directly offer services to patients | Offers Telehealth services for a specific Telehealth niche or condition, such as mental health, pediatrics, or sexual wellness | End-to-end virtual Telehealth solution to patients, from online consultation booking, virtual appointment with Telehealth providers, to online prescription fulfillment |

| Global Examples |

|

|

|

|

| Southeast Asian Players |

|

|

|

|

| Opportunities & Challenges |

|

|

|

|

| Expected End-game |

|

|

|

|

Did you know?

- Players with a focus on specialised verticals go deep in the market to meet the specific needs of patients, leading to higher customer stickiness and retention – and in turn, higher customer lifetime value

- Marketplaces and online full-stack players focus more on meeting the general needs of patients and usually face lower customer switching costs

- B2B SaaS players risk facing greater competition once the other models start building out the infrastructure for Telehealth providers, leveraging on the customer data they already have, and a better understanding of what businesses need

Comparing global examples based on financial performance

| Global Players | Him & Hers | Teladoc | Amwell |

| Description | Provides virtual Telehealth solutions for hair loss, sexual health, acne skin, and other stigmatized health conditions | Provides virtual Telehealth via platform delivering 24-hour, on-demand Telehealth via mobile devices | Virtual Telehealth provider that connects and enables providers, insurers, patients, and innovators to deliver access to Telehealth |

| Business

Model | D2P Subscription Model | B2B SaaS Model (Clients), B2C Pay-per-use (Users) | B2B SaaS Model (Clients), B2C Pay-per-use (Users) |

| Total

Funding | $272.0M | $507.0M | $1.8B |

| Valuation

(Post-Money) | $1.9B | $703.9M | $4.1B |

| Revenue (TTM) | $444.4M | $2.3B | $270.7M |

| Gross

Margin (%) | 76.2% | 68.6% | 41.5% |

| EBITDA

Margin (%) | -15.1% | -414.6% | -85.6% |

| Recurring

Revenue (%) | 58.4% | 21.0% | 40.1% |

| Product

Differentiation | Niche medical conditions; Original formulation and brand of treatment | Wide range of general Telehealth services | Allow patient data to embed into existing clinical workflows and profiles |

Did you know?

- Despite hims & hers having the lowest funding out of all 3, it is second in valuation and revenue with the highest gross margins, EBITDA margins and the highest % of recurring revenues amongst them.

- Takeaway: Focusing on vertical integration is a key factor in achieving higher margins. Direct-to-patient (D2P) subscription models bring in higher recurring revenues and hence enhance customer stickiness and increase customer lifetime value.

Key Success Factors to conquer the Southeast Asian Telehealth market

Direct-to-Patient model

- Based on global precedents, specialist D2P Telehealth have advantages in margins by going deep in the market as it is critical to understand the local patients’ needs to conquer SEA

Focus on specialised verticals

- Specialised verticals are recurring in nature and extend the customer lifetime value, such as long term medical conditions like sexual health and hair loss

- Covering conditions that traditionally have a social stigma surrounding it also brings a unique value proposition

Acquire a pharmacy licence

- Having a pharmacy licence creates higher margins as they can buy directly from manufacturers, thereby allowing greater room to offer competitive prices

Product innovation

- Focusing on R&D and extending its capabilities upstream helps to improve margins

- Customising products for better product-market fit leads to higher conversion and better unit economics

Strengthen unit economics

- Increasing customer lifetime value by encouraging repeat purchases and enhancing customer stickiness

- Reducing CAC in the long run through channel optimisation and improving conversion

Author

Kristina Ticzon, Research Manager