Our News & Insights

Salmon Raises $88M in Record Philippine Fintech Round

TNB Aura Leads US $4M Investment in PEXX to Power Cross-Border USD Solutions

TNB Aura’s Startup Wars: Southeast Asia’s Pioneer Venture Capital Case Competition

Unlocking High-Impact Opportunities in Southeast Asia’s Markets

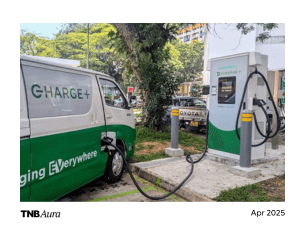

First EV fast chargers at open-air HDB carparks in operation

Eratani closes Series A to boost food security and rice production across Indonesia

Trust, Tech, and Transparency: Eratani’s $6.2M Strategy for Agritech Growth

Indonesian agritech startup Eratani secures $6.2m Series A round

Eratani gets $6.2m, looks to rebuild VCs’ trust in Indonesia

Eratani Secures US$ 6.2 million Series A, Driving the Future of Indonesia’s Agricultural Revolution

Navigating the Impact of Trump’s New Tariffs on Southeast Asia: A Venture Capital Perspective

VN Startup Banks on Co-ops to Defy Agritech Skeptics

The Next Billion Consumers: Investing in Southeast Asia’s High-Growth Markets

El Regina Tajudin: Cementing TNB Aura’s Presence in Malaysia

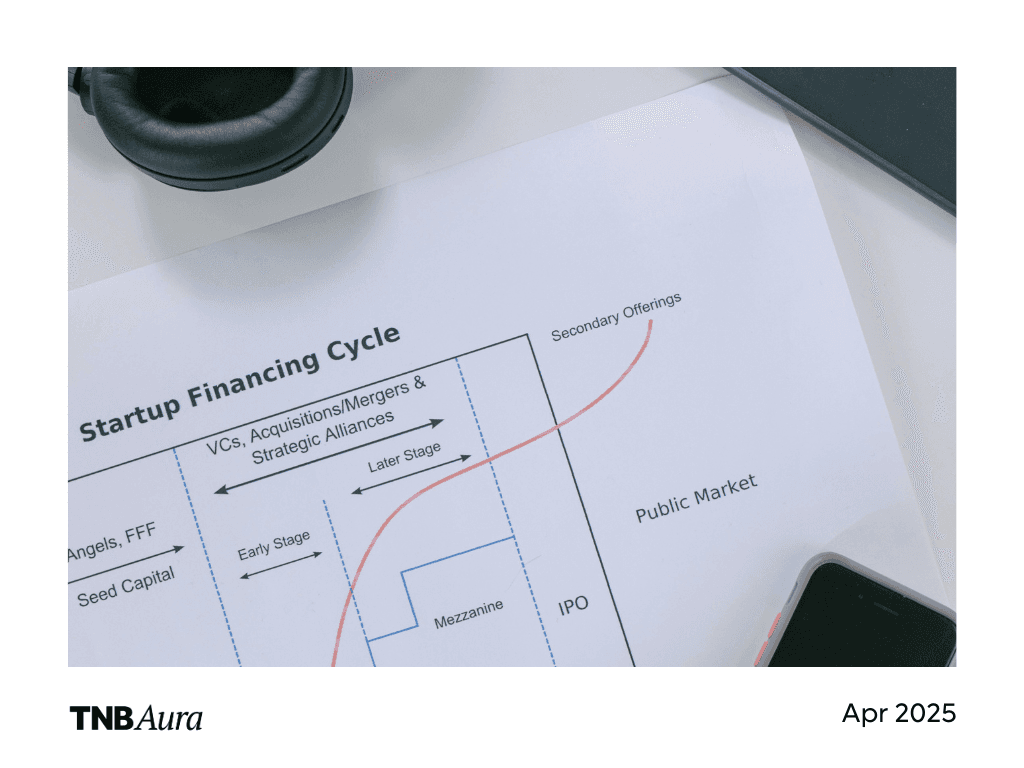

Where to List? Comparing IPO Pathways Across Southeast Asia

Ion Mobility CEO confirms acquisition by TVS Motor

TECHCOOP Secures Landmark $70M Series A From TNB Aura with Equity & Debt Funding to Revolutionise Vietnam’s Agriculture Sector

Vietnam-based agritech firm Techcoop secures $70m series A

A closer look at Vietnam’s top 5 tech startups right now

Charge+ buys 140 EV chargers from 3 companies that have ceased commercial charging services in Singapore

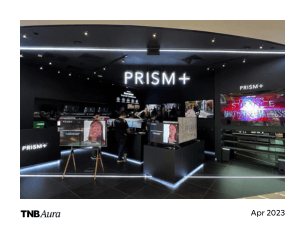

Home appliance brand Prism Tech has come a long way from computer monitors

GMA Ventures, TNB Aura ink partnership with RockMedical

VC Socials Philippines 2024: Venture capital firms, startups gather in BGC

Perspectives: Mom & Baby – Mini Sprint

Perspectives: B2B Commerce

TNB Aura joins US$8M Series A round of EV charging operator Charge+

After raising $1.6m, investment platform Invesko ropes in 20,000 Gen Z investors

TrueDoc and AiHealth merger secures funding from TNB Aura Scout

PEXX raises $4.5M in seed funding for its innovative stablecoin-to-fiat payment platform

Perspectives: Electric Vehicles Infrastructure Edition

Value Creation 101: A Perspective from a Series A Investor

Vietnamese edtech startup VUIHOC invests in ELT chain The IELTS Workshop

Indonesian ecommerce firms Sinbad and Tjufoo merge, aim for IPO

We take a look at the top 5 agritech startups and companies in Indonesia

Ice Breakers with David Bonifacio (Managing Partner, TNB Aura)

David Bonifacio: Accelerating Value Creation as Partner at TNB Aura

DEI in a Tech World

Perspectives: Construction Tech in Southeast Asia

Dutch investment firm closes $90m fund to back India, SEA VCs

Former Gojek execs’ Vietnamese coffee startup Révi bags funding from TNB Aura, others

Perspectives: Telehealth – Edition 3, Issue 2

Perspectives: D2C – Edition 5

Perspectives: EdTech – Edition 3, Issue 2

Vietnam edtech firm Vuihoc bags $6m in TNB Aura-led round

Social Impact Fintech GIMO Raises US$17.1M To Fuel Expansion And Bridge Financial Inclusion Gap In Vietnam

Perspectives: EWA – Edition 7

Perspectives: Social Commerce – Edition 4

SG Hospitality Firm Secures US $9m in SoftBank Ventures Asia-led Round

With New Partner on Board, TNB Aura Seeks to Deepen Presence in Indonesia

ORA Raises $10 Million As Demand For Tele-health In Asia Soars

Startup Fundraising in Southeast Asia Dropped to Two-Year Low in Q1 2021

Singapore-based PRISM+ Raises S$45M in Institutional Funding Round Led by TNB Aura

The Validation Check for Growth-Stage Southeast Asia Companies

At Least Seven Regional VCs Made Their First Investment in the Philippines in 2022

Southeast Asia VC Drought Survivors

Perspectives: AgriTech – Edition 6

TNB Aura Speaks at SVCA Sustainable Investing Panel 2022

TNB Aura Funds Ex-Grab Founding Exec’s Brand Aggregator

2023: Predict, Prepare for and Ride tech trends in Southeast Asia

Indonesia-based Social Commerce Platform Super Secures USD28M Series B for Indonesian Social Commerce

Indonesian EdTech company CoLearn raises an additional US$17 million in Series A follow-on funding led by TNB Aura, KTB Network and BINUS GROUP

Indonesia-based Tjufoo Launches D2C Aggregation Platform in Indonesia to Upscale SMEs

The Golden Age of VC in Southeast Asia is Here

Fintech startup GIMO bags $1.9M in Seed+ round with participation from TNBA VN Scout

Perspectives: Telehealth – Edition 3

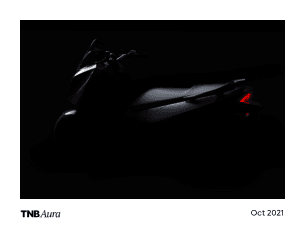

ION Mobility Completes US$6.8M Seed Round Ahead of Smart Electric Motorbike Launch

VNLIFE Nets Over USD250M in One of Vietnam’s Largest Funding Rounds

Singapore-based Zenyum Raises USD40M Series B from L Catterton and Sequoia India for D2C Dental Brand

TNB Aura Joins ADDX as First Southeast Asia VC Fund on the Platform

Indonesian edtech CoLearn gets $10M Series A led by Alpha Wave Incubation and GSV Ventures